Cinemas new normal in a 30 day window world

Welcome to a new year. It has been a very difficult year for our industry. Unfortunately the fallout from 2020 is still ahead of us. In this newsletter I will be looking into a crystal ball to help give the reader a better idea of what to expect in 2021. However, in this case I will be utilising statistics, trends, and comparative industries going through historical changes like what we are going though now.

As Small Cinema Owners, we have to be especially mindful of the future as many of us own and operate our own cinemas. Making the wrong decision could result in devastating impact on our financial futures. Much of the predictions below are not positive, but an honest and clear understanding of the situation will better equip those in a difficult position to choose the best path forward.

Specifically in this newsletter I will cover:

- The global trend of cinema/theatrical exclusivity of content going from 90 days to 31 days for blockbuster films and 17 for films everything else.

- The time frame to an expected return to normal operation.

- We will revisit the issue of digital delivery, likely on of the better cost saving developments and why it is still a difficult path.

Theatrical windows are changing

Theatrical exclusivity of content is a key issue in the viability of cinemas. If pantrons can access content at home, it has a significant effect on how many patrons will chose to go to the cinema. Historically this impact can be seen after TV and VHS impacted our industry, resulting in considerable contractions in cinema numbers.

In the following analysis I will attempt to look at this issue with an accountants perspective. In that the only goal is to maximise profits and make recommendations based on looking at the numbers and math behind were the window of exclusivity should be to archive maximum profitability. Then compare this to what is actually happening based on how the studios are behaving.

To do this, Numero data was collected to create graphs and tables that show us the level of gross turnover a film takes from date or release up until the 6-10 weeks. In this case we took two samples. Australia, top 10 films of 2019, and Australian, top 5 local films for 2018 and 2019 (total of 9 as Peter Rabbit was dropped as it was not a typical Australian release)

SPECIAL NOTE: this data represents the BEST POSSIBLE RESULTS. The gross average at 5th week will be a much higher percentage when taking all films, not just the popular films, into account.

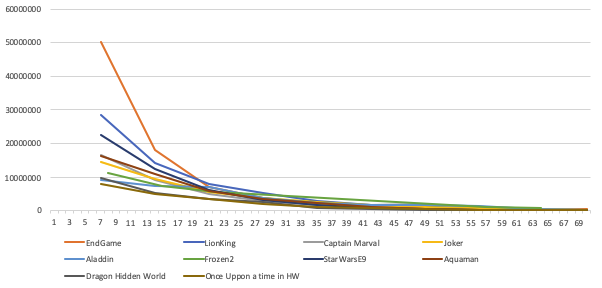

Australian top 10 Australian films 2019, Gross over time. (Graph)

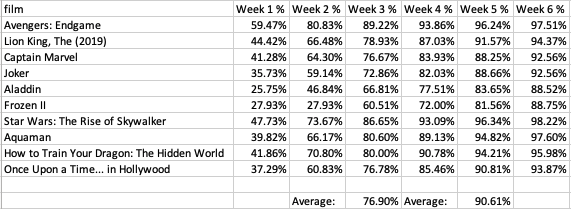

Australian top 10 Australian films 2019, Gross over time. (Table)

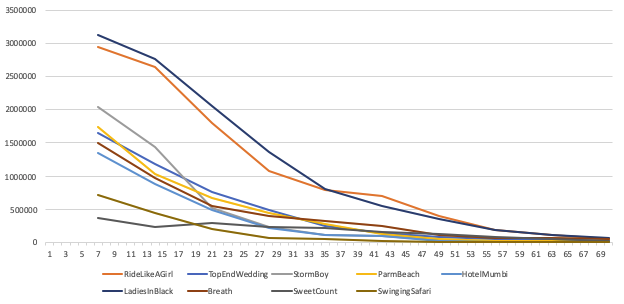

Australian top 9 Australian films 2018-2019, Gross over time. (Graph) - (Peter Rabbit, was excluded as not technically an Australian Film)

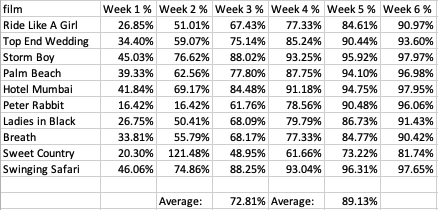

Australian top 4 (2019) and 5 (2018) Australian films Gross over time. (Table)

What does all this data mean?

The objective of these graphs and data is to indicate to the reader how long after initial date-of-release does it make sense to open a movie to a wider distribution platform. (ie. How long should the exclusive theatrical window be?)

The results of these graphs indicate that after 30-35 days a film has taken 90+% of its total gross for the most popular films of the year. Typically most films will be 95+%.

If a distributor decided to go with an average of when films are over 90% of total gross that is the time to step into the next window, we are looking at about 31 days for popular films and under 21 days for films that do not find traction in theatrical distribution.

Universal actions mirror these findings

The above conclusion is backed up by the actions of Universal and their recent contractual agreements with 3 of the biggest exhibitors in the world. These contracts dictate a 17/31 day window for 3 years. 17 days for under performing or lower budget films, and 31 days for blockbuster. This falls in line with the numbers as presented above.

All roads lead to 31 day windows

With the change in focus of the studios to streaming, it is understandable that they are following the numbers to maximise the profit of the theatrical experience while leveraging to a streaming-centric world. Theatrical will still be an important part of the release strategy, however, the studios cannot ignore how the world is changing. Historically the phrase “trading analog dollars for digital pennies” was used to describe changes in the music industry. It indicated that the shift to online music would result in far less profit. Those who resisted the trend towards downloading / streaming music have fared poorly Traditional music media has all but faded away. Many times I have heard this phrase used to also describe the recent move to streaming by the studios.

In reality a transition in theatrical distribution was always going to happen. The COVID pandemic, as in other industries, has only accelerated the time frame. The studios have no choice but to move with the times or risk being left behind.

Universal’s new contracts are 3 years long. It is expected a “Most favoured Nations” result will apply, in that other exhibitors will expect similar conditions.

The Effect of shorter windows

This is where the crystal ball gets very fuzzy. It’s anyone’s guess on how the public will behave once shorter windows become the norm. Plus we must take into account the effect of the crisis and the change in behaviour due to the lockdown i.e. Consumers becoming more accustomed to watching blockbuster films streaming on the 70 inch TVs many have purchased over the last year or so. But we can make the following predictions with a strong level of confidence.

- The shorter widows are likely to compress the initial opening week gross and overall total gross, as a small percentage of punters will decide that they are happy to wait the shorter window and watch at home. However some analyses have indicated that those who watch a lot of TV at home also watch a lot of movies in the cinema, and having shorter windows is not expected to change that dynamic considerably.

- Once content is available on streaming (after 31 days), the traction of the movie in cinema will fall significantly making it uncommercial to keep a film on screen while it is also available on streaming services. A significant number of people are likely to choose the convenient path of streaming making it, in general, not worth keeping the film on screen and competing with streaming services. Opening the next film still in an exclusive window is seen as the more commercial path.

- Any cinemas that are restricted in accessing films will no longer be commercially viable and likely fail. Regional locations no longer have the advantage of isolation from other cinemas which previously prevented local patrons from seeing the film. As regional/smaller cinemas are typically restricted access to films, with the shorter windows, if the restrictions are kept in place, these cinemas will be getting films at a similar time as the films are released on streaming platforms. The effect on patronage will be considerable and no cinema in this position is expected to survive.

Overall there will be a significant reduction in industry gross. Exactly how much is anyone’s guess but there are some possible considerations:

- Smaller cinemas (fewer screens) with access to date-of-release films and less restrictive policy requirements are in a better position to attract enough patrons to reach a similar level of turnover. It is the larger cinemas with many screens requiring many films of reasonable traction that will find it harder to metabolize the shorter windows.

- Art house distributors may decide to maintain a longer window as they rely on word of mouth and less mainstream marketing leading to longer theatrical runs as smaller films build attendance over time. Mainstream films on the other hand, have major marketing campaigns and are released with a “big initial push” for a specific date in an attempt to obtain the highest gross in opening week as possible. This is statistically sound as the data shows a larger opening week leads to a higher overall gross. This will be especially important in a shorter window world.

- Larger multiplex cinemas may downsize as there is less of a tail in the display of films resulting in the “tail end smaller screens” they have becoming obsolete.

- Due to the reduction in overall gross of the industry, at a wild guess 10-20%, it is expected the number of multiplexes in some cities will likely have to reduce to maintain the same profitability.

- Smaller cinemas who cannot absorb a reduction of 10-20% and still stay commercial are also in a questionable position and should consider closing sooner as to not overly invest in the business that will eventually fail.

Make or break for smaller cinemas

The Small Cinema Owners association has always attempted to inform the industry of systemic issues in our industry as to ensure smaller cinemas make the best informed decision. Even though I believe that small cinemas are in a decent position to transition into the new normal for cinema exhibition, there are headwinds we must be made aware of.

In numerous newsletter I have covered how our industry has systemic issues. An example of this is that, unlike a supermarket or coffee shop where it is not uncommon to have competing brands on the same street block, this is not the case for cinemas. Although Australian Consumer Law, that is encapsulated in the industry code of conduct, stipulates cinemas existing in proximity to each other is compatible with our industry, this never occurs. SCO has shown documented evidence as to why this does not happen in previous newsletter.

With the unavoidable transition that will result in a reduction of cinemas in Australia, it is expected that, if the industry selects which cinemas can run in each region, one would expect they decide which cinemas are to fail when a reduction in cinemas must occur. Unfortunately small cinema owners are likely to be on the wrong end of these decisions.

If the industry maintains its restrictive stance, it is a forgone conclusion that many smaller cinemas will be pushed into an uncommercial position. The https://data.smallcinemaowners.com.au data mining website gives us a reasonable window as to who will and will not make the cut.

To see this for yourself, please goto the following link:

https://data.smallcinemaowners.com.au/dashboard/cinemas

Click on the “Delay?” text at the top the calculated delay column. This number is calculated weekly and is made up of looking at the last number of films the location took that are considered wide release, (Over 250 screens on opening week) and then averages the number of weeks after date-of-release the location gets the films. This gives the average number of weeks the location waits before it can access a film. Considering the move to a 31 day window, it is expected that those locations with an average of 3 weeks delay or more will no longer be commercially viable in a 31 day window/streaming first world.

Current level of Small Cinema Owners in danger of closure

Based on the data collected by the SCO data mining website, this week’s calculations, 165 locations currently fit into that category. Take away some council-run and other not-for-profits, and we still have an estimated 100 sites. As you can expect, NONE of these locations are part of a major cinema chain.

What can be done to save my cinema?

With the COVID-19 crisis, our federal and state governments have their hands full. The government has shown little interest in helping the cinema industry let alone a small portion being the small cinema owners. Other cinema organisations are pushing government for mandated 90 days windows. Unfortunately, I cannot see that happening as the government will not want to regulate against what most of the rest of the world is doing. The only viable path I can see is that industry organisations should ask the government to enforce Australian Consumer Law. This should result in no form of restrictive access (all films available on date-of-release for all locations) and minimal policy as is available in other countries with strong regulation of consumer protection enforcement. If this was achieved it would help keep more cinemas open once we transition to 31 day windows.

How long do we have to hold on?

The effects of COVID are far from over. The vaccines may now be proven real and an end to the crisis is in sight, but it is still a long time before the population feels comfortable to return to the new normal, whatever that will be.

Currently, even though Australia was looking great running up to Christmas with everything seeming under control, the GROSS income for our industry on 2020 Boxing Day week based on Numero data was $19.74 million compared to 2019 at $50.52 million, ie. 39% of last year. Gross income for the first week of 2021 is tracking slightly higher, likely because of the better content being made available form distributors.

With new state lockdowns, a negative sentiment has returned that will again suppress attendance. Only after the vaccines have been distributed around the world and Hollywood has confidence to release major films on an ongoing basis will we have any chance to get back to a commercially profitable business.

Currently experts are suggesting it will be towards the end of 2021 before vaccines are distributed to a level that normality can return. I expect it may be sooner in Australia, however, the US appears to be dropping the ball and a late 2021 return is looking more likely. Hollywood and the US opening up is a key factor.

DCP Digital Distribution is a key issue

The implementation of digital distribution of DCPs has always been of specific interest to SCO as it is the “Canary in the Coal Mine” when it comes to measuring how much control the incumbents have over the smaller cinemas.

To put this in context, Disney+ can, on a specific date, stream a film to over 50 million locations in real time, however, getting a DCP to a fraction of a percent of cinema locations over a few weeks is apparently not possible.

The use of digital delivery would save distributors and exhibitors tens of millions in costs. However, major studios actively choose not to take this path. In doing so they would forgo a major tool used in restricting access to smaller cinemas.

As a small cinema owner I expect you have heard the reference “Second Run Location”. This terminology refers to the use of film prints that have already been used in a larger cinema then sent to a second smaller cinema. Film no longer exists, however, to keep this business practice alive the distributors now implement a fake limited print strategy. They only make a limited number of DCP disks and due to this they are in a position to again restrict access to the certain locations with the excuse “Sorry we have a limited number of DCP disks”.

In reality they can make a copy of a DCP on demand, but that would spoil their artificial scarcity ploy to allow them to artificially restrict access to smaller cinema locations.

Once digital delivery is the norm, this argument for restricting access to locations also disappears and is specifically why they are reluctant to implement digital delivery.

Australia is behind in digital delivery, no more excuses

Yes, Australia is starting to look embarrassing in regards to digital delivery as most of the rest of the world uses it. The distributors have started to adopt digital delivery at a snail’s pace as the distributors simply don’t want to go down this path. Deluxe has had digital delivery on the cards for Australia for about 4-5 years. Only now are they starting to do some digital delivery, however, only to approved locations. If you have not been contacted by Deluxe by now, it is likely because you are on the Blacklist or considered a “Second Run Cinema” and the pretence for enforcing restrictive access is still a tool the distributors want to utilise.

Good luck from SCO

This was a difficult newsletter to write as I am not painting a pretty picture for the future of our industry. But as was indicated to us at the start of the COVID-19 crisis, it is better to have the truth of what is occurring as so we can make a better informed decision than to pretend everything is fine. Would you prefer to be in the U.S. or Australia when it comes to riding out the COVID-19 crisis?

If you find yourself in a difficult position, please feel free to call me to discuss. Even if it’s just because you want someone to talk to that understands the difficulties of being a Small Cinema Owner.

Best of Luck,

James Gardiner

Founder, Small Cinema Owners Association

james.gardiner@smallcinemaowners.com.au

mob: 0412997011

3 comments

The content collapse – unforeseen consequences of the streaming war on theatrical cinema – Small Cinema OwnersMay 6, 2022 at 9:16 am

[…] Cinemas After Breaking Windows – Read HERE […]

A steady trend up for Australian theatrical Box Office – Small Cinema OwnersMay 8, 2023 at 8:30 pm

[…] So this is very good news, however, we may still see a significant drop after the glut of tentpole films as is seen in the graph for the 2022 year (RED line in the image above). From mid-August 2023 till Christmas, the slate is considered weaker than pre-pandemic (pre-streaming, pre-short windows) levels. However, there is a definite move by some major distributors to turn the heat up and release more films to combat this. In short, a recovery is occurring, it's not magically going back to pre-pandemic levels but we will likely get to or slightly above the levels I predicted in my early industry analysis newsletters early in the pandemic. (see https://www.smallcinemaowners.com.au/2021/01/11/cinemas-after-breaking-windows/) […]

Cinema HDJuly 20, 2023 at 12:16 pm

Such an insightful article! It’s truly fascinating to see how resilient and creative cinema owners have been in adapting to the challenges presented by broken windows. The strategies shared here are not only practical but also inspiring, showcasing the unwavering determination of small cinema owners to keep their doors open and provide exceptional movie experiences for their communities. Thank you for shedding light on this topic! Keep up the great work! Best regards, Jeanne Day https://cinemahdv2.io/