The SCO newsletter has covered digital delivery topics numerous times. At the Australian International Movie Convention this year in Sydney's State Theatre, there was a topic that was the focus of more presentations than anything else: DCP digital delivery service providers.

This was considered highly unusual as most of the rest of the world implemented digital delivery about 5+ years ago. This begs the question "Why has Australia taken so much longer than the rest of the world?" Plus, unlike the rest of the world in that there are 2-3 vendors offering it per region. Australia, being a relatively small region, had 5 (Now 4) companies battling for our small market.

In this newsletter, I will cover the current companies vying for this business, list strengths and weaknesses from SCO's perspective, and finally, examine why Australia has such a distorted landscape compared to the rest of the world. WARNING, this will be a long post. I will cover many stories and experiences I have had in this area. Considering my history as the CTO of a VPF entity and a software development company that deals in these technologies, I have a lot to say. It's a story of strategic power plays of big businesses and the fallout that occurred in an attempt to distort the markets. Hopefully, it can help explain why the Australian market is still so distorted.

What is Content Delivery

Firstly, let's go over the basics. DCP digital delivery is the replacement of receiving hard drives every week, relying on the internet to download the DCP-Data directly into a catcher device or LMS (Library Management System) or TMS (Theatre Management System). In a nutshell, it allows the industry to automate a significant portion of the running of the cinema projection process.

There were four separate presentations at the AIMC conference by three separate vendors explaining why digital delivery saves the cinema owner a significant amount per year. All three were trying to talk cinema owners into installing their solution that allows these savings.

The biggest question that should be on the mind of the cinema owner here is "Why has it taken so long for this technology to come to Australia?" It should be noted that such technologies were viable once you could obtain 24 mbit download speeds or better, for example, capable with business ADSL approximately 7 years ago. This was available even before the NBN (National Broadband Network) was everywhere. For most Australian cinemas, that would have been 5-7 years ago.

Sending DCPs is like sending emails, except DCPs are extremely large with multiple files. The traditional delivery systems are not designed to facilitate the level of data that needs to be processed. With faster networks being available to us for over 5+ years and prices going lower and lower for data downloads, this is now no longer a problem, however, custom software and technology are required to make it seamless, as is expected with an email.

Why is this so important now?

Every cinema owner knows how the transition to digital has saved them significant running costs. Typically a full-time projectionist per 3-4 screens was needed to deal with celluloid film projection. Now we are digital, the projectionist job is unnecessary, saving cinema operators a huge amount in running costs. This is innovation, allowing us to do more with less. The adoption of digital delivery and numerous auxiliary benefits it brings is also innovative. In this time of tightening monetary policy (interest rates going up due to high inflation), many cinemas will be under financial pressure. The best path through these difficult times is to implement innovative changes in the way we run cinemas.

Who are the players in Australia

These are the initial players in Australia as of the start of the year:

- Deluxe

- Qube/EIKON

- Silvertrak/MPS (Motion Picture Solutions)

- Shooting-Star (Interstellar)

- Jorr

These were the recent companies in play until recently. I am also leaving out failed attempts such as Omnilab, AICVE-NOC, Edge Digital, Hoyts and a few others that never really went anywhere.

In recent developments the landscape has changed significantly as Deluxe and MPS have a joint venture in which they agree not to compete in regions where one of them is already established. The details of this deal are unclear but in effect, the agreement between Silvertrak and MPS has been dropped and a new Deluxe/MPS division has been created. All sites with either a Deluxe or MPS box will be transitioned over to the single GoFilex solution box. It is my understanding Deluxe purchased Eclair in Europe and the GoFilex technology was part of that acquisition.

Silvertrak has gone into partnership with Telstra offering not only digital delivery but a reliable real-time streaming solution to compete with Shooting-Star Event offerings. In my opinion, a new event cinema supplier is the biggest news of the conference.

Otherwise, Shooting-Star/Interstellar has given up on its 3rd attempt to implement a solution and is now partnering up with Jorr.

This leaves us now with:

- Deluxe/MPS (Motion Picture Solutions)

- Qube/EIKON

- Silvertrak/Telstra (Now also an event cinema supplier too)

- Jorr/Interstellar

Another extremely unusual element of the Australian content delivery model is that in Australia, not only do the major two vendors insist on having a dedicated internet link that they control, but cinema owners pay for nothing. The server, the installation, the internet link, the monitoring and maintenance, and the delivery of DCPs is paid for by the content delivery entity. No other region does this. Typically in the rest of the world, the delivery box uses the pre-existing cinema internet link. The cinema pays a deposit on the delivery box. The cinema pays for every DCP that is delivered. From my understanding the prices are per feature delivery approximately $15 USD to the cinema and $50 USD to the distributor.

Australia will be paying relatively more, as the costs and management of the (unnecessary) internet link must be taken into account. Ultimately this path makes content delivery in Australia cost more than the rest of the world. Cinema owners may not care as they have a perception that they pay nothing. But in reality, the ticket sales are paying for this indirectly and the distributors are passing it on to the cinema owners.

The distortion in the market seen here is most likely a result of the bigger players attempting to push out all the smaller players who are not in a position to absorb these costs transparently. SCO believes this is an attempt by the bigger players to achieve a gatekeeper level of control, at the expense of cinema owners and smaller distributors.

SCO Recommendation

SCO specifically has the small cinema owners' interests in mind. It is very important to encourage a healthy industry that keeps important elements of our industry intact. For example, a variety of content is important. Independent distributors that enable cinemas to offer more content variety than the major distributor's selection of movies is very important.

A major change in the industry that occurred after the digital transition and specifically the end of the VPF is that smaller distributors and self-distribution has become more viable. This has allowed cinemas access to a wider selection of content to curate to their customer base.

This is especially important now as the effects of COVID, shorter windows etc, have had a significant compression of titles being offered to the theatrical market. (See a recent SCO article looking at the hard numbers in regard to these trends: The content collapse – unforeseen consequences of the streaming war on theatrical cinema - https://www.smallcinemaowners.com.au/2022/05/06/the-content-collapse-unforeseen-consequences-of-the-streaming-war-on-theatrical-cinema/).

SCO also understands that cinema owners do not want to install 3-4 separate delivery solutions in their cinemas. It's more equipment to look after, monitor, fail, and consume electricity. The requirement for cinemas in Australia to install a dedicated internet connection by the bigger two vendors is also extremely unusual. I have not found any other region of the world that requires this; it seems unique to Australia.

SCO would recommend to these vendors that a contribution to the current internet link would be preferred, specifically to upgrade it to a faster download rate. For example, if you have a 100 Mbit download (typical NBN link speed), upgrading it to 200 Mbit download would be better for all involved. Files would arrive faster and issues would be detected sooner.

It is expected that the Deluxe/MPS connection will be the predominant solution used as all the major distributors utilise this service. However, SCO would recommend cinemas also consider the installation of an alternative solution from a second vendor. It could not only be considered a backup but also help maintain a competitive market. If Deluxe became the only vendor and was then a gatekeeper to getting content to your cinema, this could result in market forces making it more difficult for independent distributors being able to offer films to your location. For example, back in the celluloid film days, small independent films were extremely restricted due to the extremely high up-front costs of a film print. We do not want to inadvertently go back to a similar dynamic.

SCO would encourage the use of solutions that are non-hardware based. Jorr is currently the only vendor offering this. This requires you to run a tool on your TMS/LMS or any computer you have access to, to download the DCP. This gives cinemas the freedom to, for example, go to an alternate location (such as the home office) to download a DCP if the office network is offline. SCO finds it extremely unusual that the larger vendors do not allow a basic fallback solution and prefer to keep millions of dollars in physical infrastructure in terms of physical hard drive delivery capability. This is likely another barrier to entry for smaller players.

In essence, SCO recommends that cinemas do not fall into the trap of insisting DCP delivery goes via any specific delivery solution, and at all times is open to alternate solutions. Even if it's downloading a large ZIP file from Dropbox/Google Drive or distributor specific delivery tool-set. This will encourage a level playing field that ensures that the quality of the content is the ultimate factor dictating how successful it can become in the theatrical market.

ISDCF paper on digital delivery

In an attempt to help push Australia forward with a digital delivery implementation sooner and as there were artificial forces and opinions of convenience to maintain restrictive practices in Australia, in 2018 I chaired the creation of a ISDCF (InterSociety Digital Cinema Forum) information document that informs the reader of the capabilities the ISDCF committee had when they envisaged the creation of the standards the industry would adopt. This document can be found on the ISDCF website:

ISDCF Document 14 – Digital Delivery of DCPs – Informational - https://isdcf.com/papers/ISDCF-Doc14-Digital-Delivery-of-DCPs.pdf

This document makes it clear what you as a cinema can and cannot do with a DCP in regard to what the head technical representatives of all the studios accepted. It may also help you understand potential innovations and their implications for cost-saving processes.

I would note that this document is inconsistent with many of the opinions of the Australian distributors, and does not give you permission to go against their wishes. But it should give you weight in asking to implement cost-saving processes.

Vendor Overview

In this section I will discuss each vendor, some technical attributes, advantages and disadvantages.

Deluxe/MPS

Deluxe is the main service provider for the major studios and as such, you are likely dealing with them on a weekly basis. It is a no-brainer to install their solution ASAP. If they allow it. For reasons I am unsure of, Deluxe has been asked by distributors to refrain from allowing certain locations to be connected to their solution. My sites are on this list. Considering I have been asking for a digital delivery solution before any other cinema and have a better understanding and troubleshooting capability than any other cinema, it is an unusual decision to restrict my cinema locations. In the event that Deluxe transitions to only delivering electronically, what happens to all the sites that are restricted from installing the digital delivery solution?

Deluxe's move to partner with MPS and to purchase Eclair and other similar companies is a major development in Deluxe becoming the de-facto standard in DCP delivery to the world.

Deluxe was very late to the game, relying on DCDC (Satellite delivery solution) in the U.S. and leaving it to the last minute to implement their own internet delivery technology, which did not live up to expectations. I suspect this is the major reason they ended up purchasing Eclair and in conjunction, GoFilex. GoFilex is one of the older implementations and is trusted and proven.

Deluxe requires you to install an internet link to allow access to their solution. This is in the face of numerous MPS solutions already installed in Australia utilising the GoFifex solution and the general internet link of the cinema. This is a completely artificial restriction that SCO recommends you push back on.

SCO believes this requirement will eventually go away as it may be incompatible with Australian consumer law.

Qube/EIKON

Only recently has Qube and EIKON joined forces. This is a reaction to the Deluxe deal with MPS.

Qube has been around for a while and is reasonably strong in some Asian countries and predominantly India, the home of Qube. However, Qube has been troubled with a poor selection in local partnerships and software implementation shortcomings, placing them behind the offerings such as Deluxe.

When Deluxe offered the free internet connection, Qube was quick to follow so as to stay competitive and to protect their investment.

EIKON is a Deluxe type company based in the UK. It is expected they hoped to be the Deluxe equivalent in the European region. Once Deluxe purchased Eclair and partnered with MPS, they had no option but to partner with any larger player open to the idea.

The Qube/EIKON partnership does lift the reputation of the solution as EIKON is well respected in its local region.

Having matured, the Qube/EIKON connection is a reasonable option for an alternate solution on top of Deluxe.

Silvertrak/Telstra

After the deal between Deluxe/MPS, what would happen to SilverTrak being in partnership with MPS was always up in the air. It was a surprise to see them at AIMC, not only giving a presentation but with a stand in the foyer ready to discuss their offerings and demonstrate the type of hardware involved.

My initial response to their solution was, "too little, too late". Deluxe/MPS and Qube already had significant footprints and contractual agreements with major distributors. I could not see them reaching a critical mass to make it worth their while. However, they do have a secret weapon which I discuss below. With the expensive initial outlay required by their solution, you need to gain contracts with a few major distributors to make the solution commercially viable.

This solution is similar to having a dedicated internet link by Deluxe or Qube. The plus to this is that the link is transparent to the cinema owner. You are not required to install an extra internet link and all the infrastructure pain that comes with it. Instead the new Silvertrak system uses a 4/5G Telstra modem. (300-400 mbit speeds)

In many ways the solution is technically superior but questionably too late, and questionably requires far more expensive hardware for implementation.

However, the major benefit and most likely the bigger news of the conference is that Silvertrak intends to also offer an event-cinema solution on top of this. In place of using Satellite, Telstra would use the same technology used to connect TV stations and outside broadcasts, to allow real time event-cinema productions. This would in effect put them into competition with Shooting-Star event-cinema offerings.

This is major news as this segment of the industry would benefit from competition in Australia.

The technology they demonstrated is capable of a far better quality solution than Shooting-Star has offered over satellite. However, in general, considering this is based on technologies utilised by the free-to-air broadcast industry, I expect best-of-breed capabilities. I am not familiar with the more recent Shooting-Star/Optus connected solution so cannot comment on it here.

I would encourage Silvertrak to work hard on its event-cinema offerings. If that gets traction, they are also in a position to disrupt content delivery with the current leaders.

Jorr/Interstellar

The current crop of service providers in this field are predominantly focused on the major distributors. Jorr specifically focuses on local and independent distributors in Australia. The Jorr solution, unlike the rest, is a basic solution that requires the cinema to download a tool. They run this tool on the TMS or local PC and it downloads the DCPs into a directory on the computer. The DCP can then be ingested into the TMS or directly into a cinema-player. There is no dedicated server or internet link required. The costs to the distributor should be far less, however, there is a problem with this implementation.

Unlike the major operators who have implemented their own intellectual property, the Jorr solution uses the following supply chain:

- Aspera/IBM file transfer technology and backbone.

- SHARC white box solution that allows DCPs to be distributed on this technology.

- Jorr utilises this technology to offer the service in Australia.

This implementation may have a lower ongoing cost, but with so many companies in the supply chain that all need to make a decent profit, it is likely to be as expensive, if not more expensive than a major vendor's offering. A major vendor is a one-stop-shop that owns all the technology in a single company.

SCO recommends Jorr is used going forward for smaller distributors, but unless Jorr can stay competitive with the larger providers, it is unknown if this model can commercially survive.

This is evident in that in recent years, the smaller distributors have been moving to the major players and Jorr-created DCPs have been seen less as time goes on, in my experience.

It is expected that home grown solutions based on internally generated intellectual property will become available to smaller distributors in the future, making similar solutions available with fewer companies involved, resulting in more cost-effective distribution solutions than currently on offer.

Interstellar

Interstellar is a content distribution offering by Shooting-Star. Shooting-Star initially offered this technology based on technology and intellectual property I developed myself and is used daily to operate my own cinemas. However, due to key clients refusing to use the technology, Shooting-Star withdrew from the agreement. This was based on a major client refusing to have anything to do with me or my technology after the fallout of the VPF Federal court case led to reputational damage for many individuals.

The Australian Independent Cinema VPF Entity (let's call it AICVE) also refused to allow the technology to integrate with any sites under the VPF. AICVE also attempted to leverage a cost to the delivery network on top. To clip the ticket so to speak. I considered this unethical and rejected any such agreement as it would make the solution less competitive and open it up to a competitor that was able to bypass this cost.

Due to this, Shooting-Star went to Eclair to implement their solution likely utilising the GoFilex technology Deluxe is rolling out now. For reasons I am not aware of, that partnership also broke down.

Shooting-Star then hired its own development team. Again this was disbanded.

Finally, Shooting-Star has partnered with Jorr, and offers the Jorr solution as the rebranded Interstellar solution, introducing yet another entity looking to make a profit from an already overburdened supply chain.

Due to the difficulties described above, SCO does not recommend the use of Interstellar by exhibitors or distributors. It would be more prudent to go directly to Jorr.

The story of Shooting-Star in this market is an indication that even with access to capable intellectual property, it was distorted business conditions that prevented this from moving forward.

Explaining the distortion

In this section, I am going to go over my experiences as a CTO of a company that implements cinema software. This will get into the board-level discussions that occurred during the negotiations period of the VPF and the benefits that were hoped to flow from them. I will not discuss the VPF contracts directly.

Based on these discussions you should get a clear understanding of why Australia has such a distorted business when it comes to digital content delivery, and possibly other aspects of the industry.

The seed that grew into industry stagnation

The background of digitAll, the company Martin, my brother, and I own is in developing intellectual property for cinemas. Emerging Pictures (U.S.) and Prasad (India) were built on software developed by Martin and me. It was common sense that cinema owners in Australia came to us to build a VPF entity that could actually do the job here in Australia. We developed DCN as a VPF entity.

As this company grew, our historic competitors for our post production company had an eye on us and wanted to get in on the deal. During discussions about the potential benefits of the DCN business model, it became apparent that our historical competitors saw the DCN strategy as a way to build a gate around what films could be distributed in Australia. The VPF entity, DCN, would be in a position to anoint a company that was capable of connecting to the VPF network.

Once in this position, the anointed company was in a position to influence what films could obtain a theatrical release or not. Martin and I understood this potential position but did not consider it of major importance as it was unethical.

However, our old competitor wanted to encourage filmmakers to only use them for production to guarantee distribution. This was especially important as it also allowed them to influence who gained access to the government subsidy "producers' offset" that was worth approximately 50% of the cost of a film. It also put the VPF entity in a position to take even more liberties to gain an advantage that I cannot discuss here.

Post production companies were also finding themselves in a more difficult position. Remember this was the time around companies like 'Digital Domain' and many others were going out of business due to a more competitive market and shrinking profits. Our historical competitors saw this coming and knew it too would go the same way unless it had something over the producers that incentivised them to still use then over going to the new disruptive and more competitive post production companies. Controlling DCN was seen as a way to hold off that pressure.

These historical competitors wanted to control DCN but only on their own terms, and would not partner with us. We felt that these companies and DCN's values did not align.

Unrealistic offers to purchase DCN, equivalent to about 1 year of profit, were made by these entities. Obviously, this was not taken seriously. In retrospect, the negotiations appeared to be a deception to obtain internal business secrets from DCN.

As was indicated by the primary Judge based on the result of the Federal court case, a plan was then planned and executed in an attempt to steal the VPF opportunity from DCN. (More detail)

Ultimately, this all started due to the potential benefits of becoming the gatekeeper of content delivery of theatrical content in Australia.

The business model that stalled the industry

As part of the Federal court case, a detailed business model describing these opportunities had to be created for the Federal court so the viability and loss of potential income could be established. i.e. so the court could establish what the case was about and how much money was involved. Typically these ideas were never written down and only kept in our heads to ensure confidentiality.

However, when the business plan was created, although confidential, it apparently made its way into many hands. AICVE, for example, was not supposed to be a party to this information, but possibly due to members of AICVE being exposed to it, AICVE took the position that it needed to run the VPF.

I specifically remember being on a call with a board member of AICVE who indicated during the call that AICVE would control the VPF and decide what company was to implement a content distribution solution for which an external entity had already been selected. I expected they were not fully informed of exactly how much control they would actually have.

Ultimately the Federal court found DCN was actually the company that had negotiated the VPF and was in a position to sign them. Technically, after this finding, AICVE should have completed the negotiations with DCN. But no, they decided to start from scratch (more delays) and called in Christie.

This resulted in the AICVE-NOC/Christie VPF. AICVE then attempted to implement a content delivery solution with the tech support staff they hired. This never worked. In effect you could compare this to someone who stole F-35 fighter jet planes, expecting to start a company tomorrow and pump out an advanced fighter the following year. As incredulous as it may sound, they expected to hire a few techs, tell them to build the solution, and have it complete in a few months. There was a huge lack of understanding in that many years of development experience and a gun-development team was required just to get started.

The AICVE-NOC also externally sourced many technologies that DCN had internally developed to perform its own support processes. Due to this, it was impossible for the AICVE-NOC to operate profitably let alone manage the production of a sophisticated content delivery solution by some support engineers.

After a period of time, AICVE was forced to sell the AICVE-NOC business to Christie. It is rumored that it was sold for $1 to take on the company debt.

Even so, the AICVE-NOC/Christie continued to lock out the digital-delivery opportunity. Christie considered developing a content delivery infrastructure and put a team together in the U.S. however this didn't result in anything from my understanding.

In the meantime, companies offering content delivery services were asked to pay a toll if they wanted to access AICVE members who had a VPF, making it uncommercial to offer a cost-saving digital delivery solutions until after the VPF ended.

And here we are, the VPF has ended and we have more companies than ever vying for this perceived pot of gold. The opportunity has passed but many fail to see this, as they simply don't understand the implementation of the opportunity. There are those attempting to implement a gatekeeper position still in this market, but there are now ways to bypass this and as such, the opportunity has passed.

From one disaster to the next

Unfortunately these secret moves in an attempt to build a gatekeeper/powerful position in our industry have resulted in significant negative effects on the independent cinemas. The VPF was corrupted and plagued with fraud, resulting in a far less beneficial VPF for cinema owners. The adoption of innovative technologies has been delayed 7+ years, again robbing independent cinema owners of huge savings. Finally, we get to the most devastating failure as a result of these events. The collapse of the independent support infrastructure for independent cinemas.

In the business development stage of the VPF business by DCN, a major issue in its planning was what was the business model after the VPF ended. The DCN model was built around providing an independent support company that could properly support the next era of computer-based cinema systems that we have now. However, with the limited size of the market, its huge area (the size of Australia), a far higher technical staff capability and cost, the likelihood that with all these automated systems, the need to travel to site would be reduced by half in general, reducing chargeable hours, etc. alternate commercial offerings by the support team would have to be developed to maintain a viable business.

Unfortunately, the AICVE-NOC/VPF was not a well conceived enterprise. This resulted in far higher costs as the cinemas ended up paying for the AICVE-NOC support contract and support from an external company at the same time. Under DCN the single contracted support cost would have done both. Due to this, the Australian market did not end up with an independent integrator in a position to move forward with the industry. After the VPF ended, the AICVE/Christie-NOC closed as it was not commercially viable, leaving cinema owners with an industry made up of older (celluloid film era) support agents that are trained for on-site maintenance and lack the IT skills expected by the rest of the world.

No other local entities or staff have appeared to replace these companies run by staff at retirement age. In the next few years, they will disappear leaving the independent cinema owners no choice but to use support entities owned by major chains. In other words, their direct competitors.

This is a significant issue that even during the initial discussions with AICVE, their top priority was to make sure the industry had an independent support agent that had no conflict of interest during and after the VPF. Unfortunately, due to the decisions made the industry has gone in the completely opposite direction. Soon there will be no choice for an independent cinema but to use a service entity that is owned by a competitor.

SCO's contribution to these developments

Under the SCO banner, I have attempted to share my unique perspective as I have had an opportunity to look behind the curtain. I could see and understand why our market was so distorted. I could see how it was resulting in significant negative outcomes for our industry. My only hope was to share these perspectives in the hope that common sense would prevail.

Currently, under the SCO banner, I have been contributing towards tools and technology examples that should accelerate innovation in our industry.

- Clairmeta - a QC tool that can be used to better automate the process of dealing with DCPs. See: https://github.com/Ymagis/ClairMeta, this in an amazing tool I have contributed to and also utilise in the more extensive tool SCO makes available, cinema-catcher-app.

- cinema-catcher-app - a set of useful computer based tools and processes available free. See: https://github.com/jamiegau/cinema-catcher-app

- Participation in the ISDCF meetings for over 10 years, contributing an Australian perspective, especially from an independent's point of view.

- The CineTechGeek YouTube channel provides training and historical and informative information that affects the cinema owner.

- SCO newsletters (which you are reading now), contain detailed statistical analyses of industry trends that all cinema owners should be across, especially in these troubling times. Many newsletters have been picked up by trade industry websites such as Celluloid Junkie.

- Technology demonstrations, some of which I will cover below.

Technology demonstrations, a peek at innovation in our industry

As part of the efforts in developing our own internal automation/TMS solution for running DCN's three regional cinema locations, I write software for most of the week. The running of the cinema has taken less and less effort as automated solutions have developed over time.

Via these tools, I have also worked on technology demonstrations in an effort to encourage innovative developments in the industry. These include:

- admin.d-cine.net, a website set up to make some of the tools developed to make DCN cinemas run with less effort. See a CTG video on it here, https://www.youtube.com/watch?v=YAQ_UmuAdoU

- cinema-catcher-app, a collection of tools for optimisation of DCP data transfer, QC-Check, and data analysis tools for a cinema owner. This is a free download that allows cinema owners to see some innovative tools implemented from a cinema owner's perspective.

- Content Distribution platform. In an effort to keep the industry honest on the topic of content distribution and encourage a less restrictive approach by the industry, I have shown working content distribution systems that were developed for use by DCN in its cloud-centric TMS/Cinema management solution.

A content distribution demonstration

To help demystify a content distribution system suitable for DCP distribution, I will show some images of a working solution developed by digitAll/DCN. This solution is based on open standards and infrastructure to allow easy deployment and scalability. This demonstrates that independent distributors themselves could partner with a company like DCN to introduce this capability without having to utilise expensive external service providers in dominant positions. In other words, to keep the other providers honest through a reasonably priced alternative.

In this example, a number of trailers were ingested into the admin.d-cine.net solution. As DCN uses the booking solution that is part of this solution, it knows what films DCN has booked and for what location.

As trailers or features enter the system, they are automatically assigned into distribution tasks based on the permissions of distribution assigned to the incoming DCPs. In other words, as the trailers/features come into the admin.d-cine.net solution, they are automatically assigned for distribution to the three DCN sites as they are slated to play those movies in the future.

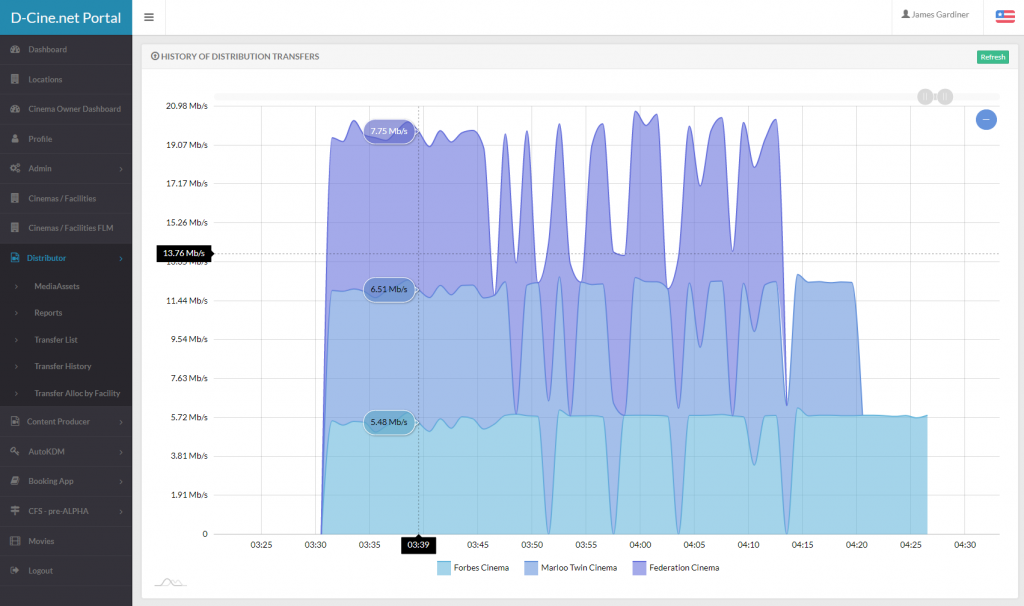

The following image shows how the system monitors the transfer rate for each site connected and the throughput/transfer speed. This is used to quickly identify any connectivity or bandwidth issues.

From here, every time a DCP lands into a Cinema, it is checked and verified against the industry standard Clairmeta QC check system and emails sent to the cinema owner/projection-admin so they know a DCP has arrived and the status of the DCP in terms of standards conformance.

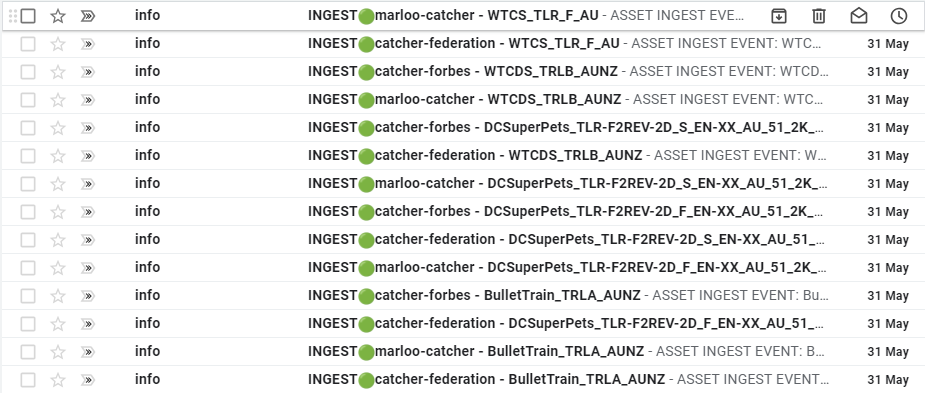

Below is a capture of my Email inbox and the Emails generated by this process.

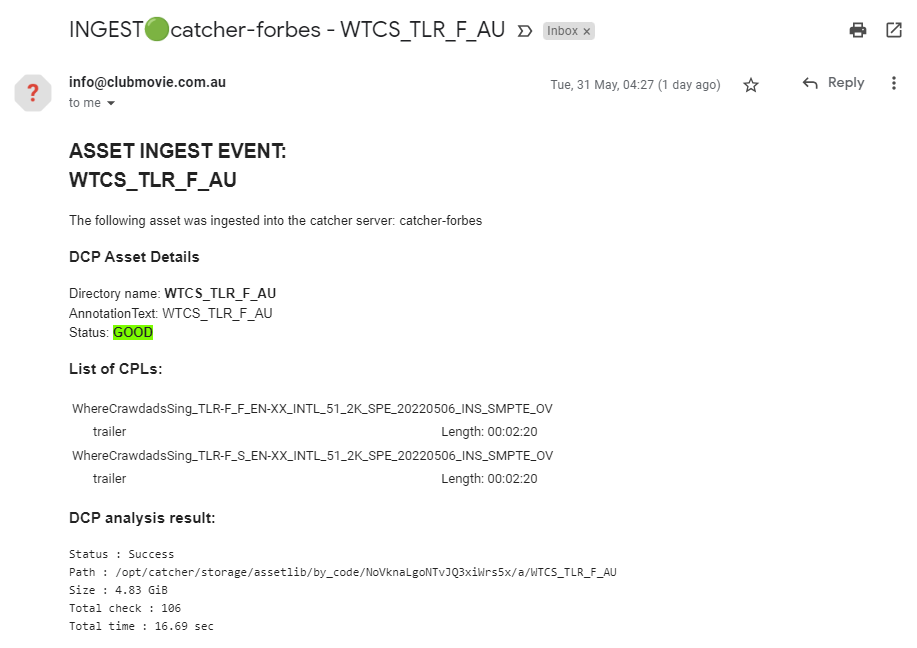

From here, you can open an Email and get a very detailed inspection of the DCP.

As you can see, it lists the CPLs in the DCP and any possible errors will be shown if present.

This makes it easy to quickly review my email each morning. If any email has a red light over a green light, I know there is something I need to attend to. But in general, if the studios have sent the right DCP and KDMs, I get green lights and know there is nothing I need to do; the automation system has done everything and checked it is all consistent with the booking schedule in place.

This is a technology demonstration and shows exactly how far we can go with innovative ideas if unrestrictive development in line with the original ISDCF expectations were allowed to occur. This will lead to significant innovation in the industry, leading to doing more for less and ensuring the cinema industry stays viable in these difficult times.

Conclusion

Firstly, if you are still reading this congratulations, this is a very cinema industry-centric post. I hope this newsletter encourages independent cinema owners and independent distributors to be open to taking advantage of innovative processes and to be mindful of distorted industry behaviour.

The main message I would like to share here is that some of these issues that appear small and insignificant, such as the way content is delivered to your cinemas, can have a significant impact on the industry and its viability. I would encourage cinema owners and smaller distributors to especially be aware of these decisions and how they may affect them in the longer term.

I would also suggest you seek out and discuss these issues with well-informed individuals. For example, what has occurred, I predicted and advised many individuals as the decision were being made. It was unfortunate that this information was not shared.

Finally, I would suggest you share this article with those you think it will have an impact on.

More Free Tools From SCO

SCO is excited to announce the release of the "DCI-Player Playout Audit Tool". See https://github.com/jamiegau/cinema-catcher-app

VIDEO DEMONSTRATION AVAILABLE HERE: https://youtu.be/7ZEj2FhvOis

This tool is used to pull all playout data from DCI-cinema-players (Barco, Dolby, GDC, Qube) and insert them into a database. From this database, you can Audit content a screen has played based on specific criteria.

For example, this tool can be used to search for certain activities on screens at a location. These reports can then be used for the following:

- Extract activity of certain CPL at a location based on any attached metadata. For example, Digital Cinema Naming Convention (DCNC) characteristics

- detect trends in player activity at a location such as, was a screen manually controlled or nonscheduled shows were played.

- Detect if sessions outside of operation hours occured and email an admin when it occurs.

- Send reports for Advert-DCP/CPL playout from a specific advertiser. (Hourly/Daily) i.e. Advertisement Auditing.

- Engineer analysis of system behavior during a fault.

Reports can be scheduled to be sent in two ways:

- An email with an attached CVS file

- JSON data sent to a Website EndPoint, i.e. http://advertiser.com/report_endpoint

This tool is expected to strengthen the advertisement industry in Cinema as auditing can now be performed and is now a very important factor as it is expected in Internet-based advertising.

James Gardiner

Founder, Small Cinema Owners Association

james.gardiner@smallcinemaowners.com.au

mob: 0412997011