It's been a long time since the last SCO newsletter. There has been little to say as if you don't have any good news, why say anything at all?

So yes, there is some great news. After a lacklustre start of the year, very much trending similar to 2022, we are starting to see a substantial trend up with Guardians of the Galaxy Vol.3 initial numbers trending higher than Vol.2.

This is excellent news and welcomed by all cinema owners. After a run of softer then expected superhero films, GG3 was very much a trend maker, likely indicating the attitude towards this genre of film. These early results are great, not only for GG3, but for "The Flash" as well.

Before we continue with my analysis, I need to do some house cleaning. Due to this difficult period, like many, I have decided to diversify. Unfortunately, this leaves me with less time to contribute to SCO and the other tools I make free to the industry. These developments will slow down, but don't worry, I will continue them. I have taken on 2 more roles. I now support an audio post house (www.boomtracks.com.au) that does a lot of work on U.S. feature film productions, good for keeping my post-production knowledge up to date. Plus, I have also agreed to support certain cinema entities in helping out with IT and cinema technology and support. Specifically upgrading and installing the Comscore/Hollywood software ACE-TMS solution. But more about that in the second topic of the newsletter where I will cover "The mess left over from the VPF"

I still run my 3 small cinema locations and contribute to my free software (cinema-catcher-app) and SCO. So I have a lot on my plate.

The Good News

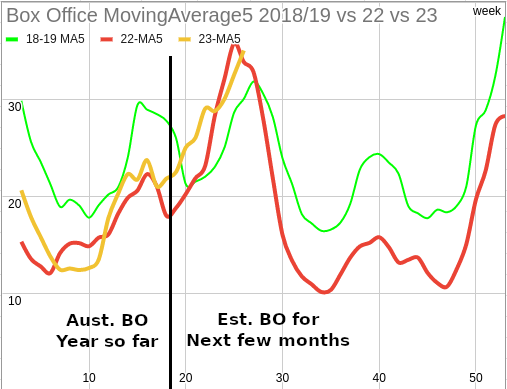

Up until recently, the Australian Box Office was performing poorly. In the graph above, you can make out how the RED-LINE of 2022 and the ORANGE-LINE representing 2023 are trending very similar BO results. With GG3 opening well. With the plethora of tent-pole films over the northern hemisphere summer holidays, we are heading into the most profitable part of the year driven by blockbuster franchises. The graph above represents the moving average over 5 weeks to smooth out the peaks, the BLACK line separates the current real Box Office numbers and the future estimations. The estimations are very rough and could be considered conservative, even still, we are heading into pre-pandemic levels of Box Office and Attendance.

So this is very good news, however, we may still see a significant drop after the glut of tentpole films as is seen in the graph for the 2022 year (RED line in the image above). From mid-August 2023 till Christmas, the slate is considered weaker than pre-pandemic (pre-streaming, pre-short windows) levels. However, there is a definite move by some major distributors to turn the heat up and release more films to combat this. In short, a recovery is occurring, it's not magically going back to pre-pandemic levels but we will likely get to or slightly above the levels I predicted in my early industry analysis newsletters early in the pandemic. (see https://www.smallcinemaowners.com.au/2021/01/11/cinemas-after-breaking-windows/)

The BO is up but we must look granular

A health industry box office does not tell the full story. David Hancock (Chief Analyst, Media and Entertainment at OMDIA) recently shared the following post found at (You need a LinkedIn login to see) "https://www.linkedin.com/feed/update/urn:li:activity:7060211534039261184/". The post specifically argues that the success of the theatrical cinema industry is directly proportional to films being released. More films = more Box Office. This is historically correct, however, I would argue there is more to it than that but we will visit that issue later.

The more important issue to take away from this graph is that although the tent pole films are doing great, everything else is doing worse. The top 10 films may make nearly as much as pre-pandemic, while all the rest are doing worse at 30-40% down.

Having more films is not the actual issue here. It's having more GOOD films released at the right times, not all so close together, that matters. Exhibitors have always had more films to show than they could deal with, it is the sign of a good cinema proprietor who can select the films that work best for the demographic they specifically cater to. Independent cinema operators tend to rely heavily on well-curated presentations or in other words. They rely less on the blockbuster as a way to offer a point of difference over the larger chains.

An example of this in recent months is obviously "Super Mario Bros". It performed way above its expected level, and thank heavens for that, as every other film was strangely weak. "Antman3" and "Dungeons and Dragons" greatly underperformed. In my opinion, pre-pandemic. these films would have performed much better than they are today. Consumer behaviour has changed, Some films are performing weaker than expected and some stronger than expected based on what we as cinema owners, with decades of experience, would have expected.

So Box Office may be returning to a respectable level, but it does not mean we can go back to everything as usual as was before the pandemic. If we don't change or modify some of the business models behind theatrical exhibition, we will lose more cinema locations than is needed.

Will theatrical exhibition ever return to the same Box Office level?

This is obviously yes, however, how we achieve this has changed compared to pre-pandemic. Consumer behaviour has changed and more options are available to them. This is leading to a fall in visits per year per person. This is a manageable issue as with all supply and demand issues, we simply lower supply in one region, and up the supply in under-supplied regions. With Australia having the highest immigration level ever, and the urban sprawl expansion, there will be many new opportunities for more cinema locations in the future. Many cinema locations this population growth targets, are likely to see an uplift.

Unfortunately, these positive developments are not spread equally. For smaller cinemas, typically in regional areas, the population growth through immigration is unlikely to have an effect.

Trends to be aware of

Following are trends in theatrical exhibition we should be aware of as it is likely to affect the viability of your cinemas. How one cinema adapts to meet the changing behaviour of the population may be different to another, and only the cinema operator on the ground is in the best position to navigate these issues. It is hoped that sharing some of these insights will improve the likelihood of a cinema navigating these difficult times.

- Films have a shorter shelf life: This is a big issue for smaller cinemas as excessive policy commitments to access a film are inherently very damaging to the viability of a smaller cinema. It is common for a small cinema to agree to a film on a long policy commitment, knowing that it will play out in the first 2 weeks, and then be stuck with near-empty sessions for the second two weeks. This path is still better than having nothing to show at all. Shorter windows have compressed the long tail of all films, making it harder for smaller cinemas. This also makes selecting the right films of critical importance as, if a small cinema selects the wrong film, you cannot simply move another film over from another screen as you are not in a position to book more than a limited number of films. You can only then obtain a better-performing film on 3rd week at best. After such time, it's too late anyway.

- Consumers are more ready to wait for a streaming release in a streaming world: This is predominantly evident in that in the graph from OMEDA above. Mid and arthouse films are still significantly depressed in attendance. This leads to having a well-curated cinema having less uplift in attendance, and we must rely more on the broad appeal films/tentpole films. This in turn, makes it harder to compete if in the shadow of a larger chain.

- Attendance levels are still clearly compressed in Australia: Due to a higher debt level per person and interest rate rises, Australia appears to be lagging behind the rest of the world in terms of returning attendance. This is also exacerbated by ticket price inflation, hiding the fact attendance levels are still very low but with higher ticker prices in many metro markets making this less obvious.

- Higher power and rental costs are distorting the policy power of the exhibitor: some exhibitors have indicated to me they want to introduce a power and expenses surcharge to the ticket price as, from their point of view, they are having to spend a lot more money to obtain their percentage of the sale. This is distorting the benefit of the ticket profit margin significantly in the distributor's favour. In effect, this is an argument for lowering terms across the board for all cinemas. Definitely a touchy subject but one that needs discussion.

- With short windows and the release of some films being staggered around the world, we are starting to see a decent number of films hit the pirate networks weeks before an official release in Australia. I have a saying. "Streaming anywhere, piracy everywhere". Piracy is referred to as an existential threat to cinema and it is expected that the potential Box Office take is eroded by 15-30%. This is occurring often enough to be of concern. It is also particularly negative for regional independents as, with smaller cinemas, you are not in a position to offer every film (ie. limitations of policy requirements) and as such, piracy is more common in those markets. Discussion of policy and the freedom to react to these unfortunate events should be tabled.

- Streaming demand for content is reducing the number and quality films the industry will have access to: The production industry is a finite resource. An example of this is the WGA strike currently on in the U.S. The writers are a limited resource, and until they come back to work, production mostly comes to a stop. You cannot just go and hire more. With Streaming services now competing for this resource, it is becoming harder to make as many "quality" blockbuster films as we once did. Telling the studios to simply "release more films", is short-sighted in that it's far more complicated than that. There is a supply chain issue. The message here is that we must be mindful of relying on these magically successful films coming through in a sea of soft releases. "Super Mario Bros" is a good example. The risk level of a poor period of attendance has increased, and with higher risk comes higher mitigation costs. (i.e. if you are a higher risk, the bank wants a higher interest rate.)

- Consumers are going less but when they go they go big: IMAX has had the best 1/4 yet, showing how consumer behaviour has significantly changed in that, as they go less when they go, they choose to go big and flock to larger and more quality experience offerings. This has led to a growth in chains spending big on upgrading screens to PLF-type offerings. Motion Chairs, ScreenX, etc. This again distorts the Box Office results indicating, although the Box Office return is looking healthier. It is predominantly leaning towards chains with PLF offerings. As small cinemas, apart from the installation of recliner chairs, this is not a market we can access. It also shows that smaller independents are still much worse off than the generic Box Office numbers indicate.

- 6-8 screens more than enough: It is no coincidence that many new cinema openings in green-field regions are only installing 6 screens. The large chains have done the math against the trends in slate releases and consumer behaviour in attendance level per person per year. This trend was already occurring before the pandemic. This indicates the chains are more likely to encroach on regions typically left to independents.

- Quality customer contact is a competitive edge: Over the last 20 years, it has been interesting to see how larger chains have implemented changes to allow a cinema goer to have a cinema experience with the least amount of contact with staff possible. Staff are one of the biggest costs to any company, so this is understandable. As the industry leans more towards quality experience cinema, good experiences with courteous staff have become one of the bigger reverse-course developments in larger Chains. Like every chair is now a recliner, every experience should be like a gold-class cinema with staff offering you a quality exchange making you feel special. Independent cinemas have always known this and it was one of the advantages they had over the larger chains.

- Cinemas are no longer "Just cinema with concessions": it is common to see news of new cinemas opening every few weeks on my LinkedIn feed. However, the big change is that all the cinemas opening in recent years are not just cinemas. They are entertainment complexes that have cinemas as part of their offerings. Due to the change in attendance and slate, it has become prudent to put all your eggs in more than one basket. If the cinema is not doing well due to a spat of poor content, the rest of the complex is. Bowling, Restaurant. Bar, Sports-Bar, Laser Tag, Escape Room, VR-Room. As an established cinema, it is hard to expand into more offerings. The purpose-built complex is set. Larger chains, however, are turning a 12 plex into an 8 plex with the conversion of the unused cinemas into an entertainment complex offering.

A strong message in the trends above is that diversity is key to the future of cinema. I would have to agree with this as I have diversified my sources of income due to the trends seen above.

Diversification is the key

In a story on the ABC news website called "Independent community-run cinema struggling to survive calls on movie goers for help" (https://www.abc.net.au/news/2017-12-01/independent-community-run-cinema-struggling-to-survive/9215956), Under the heading "Diversification is the key", Scott Seddon, President of ICA is quoted as saying

"He said the challenge was to get as many films as a early as possible to meet the demands of an impatient audience eager to see films as soon as they are released.

At the heart of it, he said the key to the survival of any independent cinema was passion but also, the current trend to diversify into food and beverages."

ICA would also appear to agree with this sentiment, however, I would offer some advice. The industry has put a lot of effort into making the cinema experience a special one that has its own position in the market. Although the trend around the world is diversification of offerings, it would be prudent not to push too hard beyond what we offer today. If cinemas decided to become more like entertainment complexes, would it not be common sense for entertainment complexes to become more like cinemas to combat this competition? This is an interesting topic which needs more discussion.

Forwarned for success

It is hoped this newsletter covering many of the challenges for smaller cinemas can help them navigate the changing environment. Good Luck.

The mess left over from the VPF

In the newsletter part 2, I would like to go over some fallout left over from the VPF (Virtual Print Fee) contracts. As I have expanded into helping other cinema owners manage and upgrade their projection room IT, specific problems have come to light that affects many independent cinema owners. I will describe what they are and tell the story of how we got here in the hope that we can avoid poor decisions like this in the future. This is especially important now as the ICA conference is about to start. Although I would like to be there in person to put forward my opinion, I am banned from becoming a member for reasons ICA will not say, but I suspect due to my opinions below. I would appreciate it if other members who may read this could hold the torch.

The Problem

The equipment from the VPF is over 10 years old. Much of it is well overdue for replacement and upgrades. As I am well known for having extensive knowledge of how projection systems work with my reputation in developing innovative products in cinema, naturally I get asked to help often. So I decided to contract out to select cinema operators I respect. In this case, I would upgrade a Theatre Management System (TMS) and other network equipment.

During this stage, we researched upgrading AAM-Screenwriter and Hollywood software (ACE) as both were in use. Unfortunately, although Screenwriter has a free version, which anyone can technically install, David Ong, Vice President of Asia Pacific at Arts Alliance Media, indicated to me only the chain-owned integrators are supported to install that software in Australia. i.e. you must buy it through the chain-own-integrators under the model they support. For example, an independent would be required to spend $15k on a server over a computer they could source themselves for as much as $2-3k. Due to this, we were forced to abandon upgrading a site utilising Screenwriter and convert it to Comscore-Hoolywoord-ACE-TMS. A good example of a lack of options in the market leading to negative outcomes. This will be discussed in detail below.

Moving to a basic hardware and software upgrade of the TMS, You would expect this to be simple, but no. Large roadblocks existed requiring significantly more money to be invested in achieving this. Significant costs, that we as exhibitors don't need right now.

Specifically, the decision to utilise the Christie NOC and the onerous restrictions imposed on the cinema owners have had a long shadow of poor outcomes. Some examples of this are.

- The projection network had unrequired excessive security constraints resulting in large excess costs when doing basic service work. For example, for an engineer to simply plug a device into the network to do some diagnostics required the NOC to allow this. This then involved an expensive engineer to enable and disable this basic function. This function was only allowed by approved entities that had agreements that the cinema owner was not a party to.

- The ability to utilise competitive quotes by other service entities was impossible. This likely resulted in higher costs as the cinema owners were locked into utilising the entity that had the passwords etc to allow administration of the network.

- Access to new technologies and tools to streamline the projection room function where locked out unless they paid extra costs to the entity that controlled the network. It is no coincidence that content delivery companies only started offering their services in Australia after the VPF had ended, while it was all the rage in the rest of the work 5-7 years earlier.

After the VPF, the NOC collapsed as it was not profitable enough to maintain. However, cinema owners were not given access to the secret passwords etc so they could take control of the equipment they own.

When I tried to service the site, asking for individuals who I knew had access to these old passwords, they simply refused to give them to us. I consider this outrageous, considering the cinema owns the equipment. Unfortunately, we were left with no choice but to replace the core switches in the network. Adding a significant cost that could otherwise be avoided. The cinema owner was happy with this as it was incomprehensible not to have control of their own cinema network, so whatever it took to do this was the only path forward. Specifically to ensure the cinema owner could then go to any competitive service provider going forward.

In the upgrade of the site, it was specifically implemented in that if the core switch did fail, any switch with enough ports could be utilised to overcome the issue in the short term until it was properly addressed. This was not possible with the ICA/Christie setup. If a switch failed, a new and exact model had to be sourced by the NOC, it had to go to them so they could install the same restrictive programming so it would allow communication with the other screens. It was then dispatched to the cinema and installed by a NOC-approved entity.

Obviously, if you were a regional location this would likely take more than a week to implement. While the client I serviced has an older spare switch they had left over from other work, being fine to limp on until the correct equipment could be obtained, installed by capable cinema staff and any special setup done remotely. Downtime is minimal with implementation costs being a fraction compared to maintain the ICA-NOC implementation.

My professional opinion is that it was an injustice to have allowed independent cinema owners to be taken advantage of like this. An opinion I shared numerous times with ICA members even before it was implemented. The VPF contract itself, although a secret document, had paragraphs to discourage this behaviour but did little good as no one could see it. And those who did choose to do nothing for reasons you would have to ask them.

The ICA/Christie NOC implementation is a mess and needs to be backed out of independent cinemas in Australia. This is a mess that someone will have to pay for, and unfortunately, the cinemas will have to bare this cost.

So how did we get here?

Understanding how we got into this poor situation will take a story going back to before the VPF and how it came about. I feel this is an important story to tell as the cliche goes. "If you don't learn from your mistakes, you are destined to repeat them."

When the VPF was only starting, Michael Smith, MGS Group who had a history of installation of cinemas was keen to obtain this for the industry. The studios told him to go away until he found partners that had the IT know-how. As everyone will remember, the original VPF entity was called "AccessIT", an IT company (It's in the name). As cinema was very much an analog based world, jumping into digital would require specialised IT knowledge with a company that also had programming capabilities as is seen in all large integrators still around today.

This led to the partnership creating DCN, of which I was a director and head of IT. The Gardiners (Martin and James), as we were known, had developed the eCinema technologies used by "Emerging Pictures"-US and "Prasad"-India and many Australian Independent cinemas. We developed technologies to allow DCN to roll out and maintenance of 100 sites giving the studios the confidence DCN was capable of servicing the 10 year VPF contract. During this time I developed how the projection network would operate, our own internally run support network and monitoring tools, how the support staff would work, and ultimately the business model that would allow a profitable independent Australian support entity during and hopefully after the VPF ended. It was a difficult process as we could not archive a viable company at the service cost demanded by ICA unless we leverage the business into axillary services. This is where we developed ideas like content delivery of DCPs to VPF locations. This was all in the business model submitted to the courts.

As all cinemas who accessed the VPF know, it was at this time a fraud was committed in an attempt to move the opportunity into an alternate entity. I understand a number of industry pundits like to paint an alternate narrative and many ICA members were poorly informed if not lied to, but in a nutshell, over 14 million dollars and 3 years were spent digging up documents through discovery. Although Smith somehow lost all his emails and refused to hand over any documents, these surfaced via the other parties these documents went to. In the end, the judge indicated that those who gave evidence were not to be believed, and only via analysis of the 3 years of Emails was the truth evident. This ended up with all 4 federal court judges unanimously backing DCN as the entity that was about to sign the VPF with the studios. And that the fraud was planned and executed by those involved.

During this time, numerous meetings occurred. During these meetings, it was made clear a number of times to individuals representing ICA that.

- If ICA chose to go down this path, it would likely cause the VPF to "blow up". Which did occur.

- If ICA chose to go down this path, it would likely result in the destruction of any opportunity to create an Australian independent integrator entity. This has occurred, and the industry is only now realising it.

During some meetings, it became clear to me that individuals in the industry wanted to take advantage of the opportunities identified in the DCN business model for themselves. Controlling the Integrator was key to these plans.

From my perspective, this is plainly evident in that when the Omilab/ICA defence in court failed, and Omnilab was no longer a viable choice, it was expected that ICA would go back to the company that actually had done all the work in the first place. DCN. It was the obvious choice.

But why didn't that happen?

From my perspective, it was how the VPF was then set up with Christie. ICA controlled the integrator. It had access to these opportunities as outlined in the business model. Opportunities others wanted to obtain/control.

This resulted in the industry implementing a Christie VPF with ICA running the NOC.

Only 3 or so years later, ICA sells the NOC to Christie. From my perspective, I always questioned how they could maintain that business. ICA simply went out and hires 3 support engineers, paid for the monitoring tools (DCN had it own intellectual property to do this without cost), paid for the network access (DCN had implemented their own Network layer avoiding this cost), giving them a business model document, and expected it all to simply happen.

There was no chance the NOC could, in my opinion, be a viable company during, let alone after the VPF. Having a business model document written by someone else does not give you the know-how that went into developing the document.

Christie was then forced to purchase the NOC as, if the NOC failed, the VPF would also Fail. Chistie had to absorb the losses to maintain the VPF.

During all this time, the NOC restricted any external entity attempting to implement these opportunities, plus monopolised any service being performed by potential up-and-coming integrators.

It's been 15 years and not one, up-and-coming company has chosen to enter this field. I have seen a few put their toe in the water, but that's about it. If you have the know-how to service this industry well, you also have plenty of other opportunities to service non-cinema-related industries. With all this distortion of the market, no viable company that could do this type of work would stick around.

My issue with what has happened is that, due to these poor decisions, in a very few years we will have no option but to utilise integrators operated by the larger chains/competitors. I support my own cinemas as I can, but I don't want to do it forever, so have been keen to spot a new independent company to do this work in the future. Even Mark Sarfaty, when the initial talks between DCN and ICA occurred. The top line item Mark wanted was that the VPF must result in a country-wide independent integrator during and after the VPF. I couldn't agree more then and especially now.

The current independent integrators are getting too old, and/or developing health concerns. During all this time, they have been unable to grow beyond running integration in their own local regions. Once these people retire. Thats it. No independent company is coming to save us. It will only become more difficult to operate a cinema as, even though I don't consider some of the chain lead integrators that bad, they have a conflict of interest that will manifest in how they support the independent cinema owners.

How do we fix this?

I have no idea. I feel it would be a good time to open this topic in ICA. I am surprised there is little discussion of this topic based on information I hear coming out of ICA. I am hoping socialising this information will help us focus on these important issues as an industry, even if I am banned from taking part.

That is the real shame, as I feel I have much to offer them.

James Gardiner

Founder, Small Cinema Owners Association

james.gardiner@smallcinemaowners.com.au

Ph: 0412997011