SCO Newslatter, Jul, 2023

We now have 6 months of attendance data giving us solid metrics on where the industry is going. In this newsletter I will cover exactly where the industry stands. How much trouble it is in, and what can be done to address it. I will also be discussing efforts SCO has been taking in an effort to help small Cinema in this difficult environment.

Barbenheimer has been an extraordinary event. It has lived up to all expectations and more. However, how well it holds is still an interesting question as both films are niche. Barbie, indexes strongly to only 50% of the market (females), while Oppenhimer is very much an (overly long) arthouse drama. These factors would tend towards a shorter tail than typical unicorn films. (Unicorn: a very rare animal to find.) But time will tell. It has out performed even optimistic metrics.

The industries current status

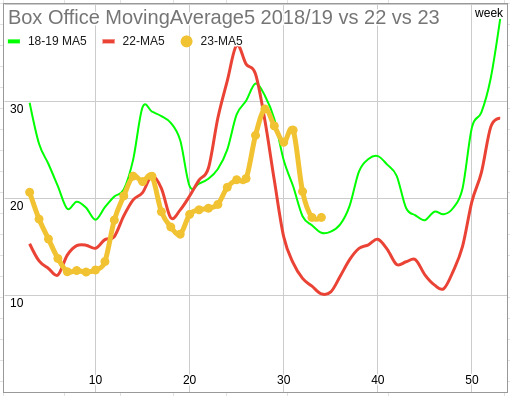

Starting off with the hard numbers, below is a graph showing the performance of the cinema industry in Australia compared to pre-pandemic and the previous year, 2022. A moving average of 5 is used to smooth out the bumps to make it easier to compare year to year.

* Note, the data contains predictive data beyond the current week based on typical performance levels expected from a first week peak Box Office level of Barbenheimer.

This diagram shows that in the first half of the year, the industry has been trending significantly below 2022 levels. This is very much unexpected as the number of films and the quality of films was expected to be better then 2022. It is mostly because of Barbenheimer that the start of the second half of the year is performing strongly and making up for much of the loss in Box Office in the first half of the year.

However, the significant trend in this data to focus on is that, in general, films that were once considered money in the bank, are no longer performing as such, with across-the-board extremely soft Box Office performances.

Barbenheimer may be pulling us back into a similar or hopefully slightly higher Box Office for 2023, but if the first half year performance is consistent for the rest of the year, we are likely to see very little gain over 2022 Box Office. We cannot rely on Unicorn films to keep showing up on a regular basis. We need a constant and regular return on films on an ongoing basis keeping us commercially viable, with the Unicorns being the random bonus.

The expected lack of Box Office for 2023 does not take into effect significant rises in power bills, insurance, and nearly all outgoings. The reality is that if you didn’t make money in 2022, based on the trends seen in the Australian Box Office, you're not likely to see a significant lift for many years to come.

Additional to this, we still have a likely recession to contend with and a famine in content as the actors strike impact grows as the strike grinds on.

As a cinema operator, this is very disappointing. I have held out writing this newsletter for quite some time as I wanted some good news to bring into this narrative. Barbenheimer is a good start, but keep reading, I have another more robust take outlined below.

What is the industry doing about this?

Here at SCO I have been working on these issues for longer than I can remember. Regular readers would have seen my industry analysis in a previous newsletter that predicted these outcomes. Plus the ongoing updates to the graph as seen above that are a clear example of trends in attendance levels going forward. SCO focuses on small cinemas, but much of what I cover also impacts major/mini-majors too. To help put all this into context, a brief overview of the actions taken in 2023 will be outlined below.

Back in May 2023, the ICA conference occurred. I did not attend as I am not welcome and barred from joining. This is mostly because I have a strong belief in transparency as is demonstrated by my Youtube channel where I commonly state, “An informed decision is the right decision”, while the ICA board keeps all meeting minutes secret from its members. However, I do keep a close eye on ICA as it is supposed to represent the interest of independent cinemas. I would have expected the organisation to welcome my membership and how I am very forthcoming with analysis and technical knowledge. Unfortunately I am left to contribute to the industry in my own way.

The biggest news to come out of the conference was that in New Zealand, distributors were abandoning policy enforcement.

Just to be clear to the non cinema operator reading this. Policy enforcement for small cinemas typically results in

- the inability to run as many films and offer more variety.

- Forcing small cinemas to push films off screen that are still attracting customers.

- Forcing small cinemas to over play content resulting in far more low attended or empty sessions

The ability for a small cinema to play more films and react to the customers and what they want to see is expected to allow smaller cinemas to lift Box Office by 10-20% over what they can currently do under the restrictive policies enforced.

As you can expect, SCO and I as a small cinema operator were very interested in this change in the cinema business model as demonstrated in New zealand. I asked my friends in ICA to follow up this extremely important topic. Unfortunately, the feedback from a board member was that ICA did not want to approach this topic as if they did. They felt it would reverse this behaviour for the New Zealand operators. An extremely strange position to take. This policy change has occurred in New Zealand as a last effort of the industry to hold back a mass collapse of smaller cinemas.

Due to this, I decided to do something about this myself as the representative of SCO and the viability of all small independent cinemas. As the information in regards to this was near non-existent, I contacted numerous small independent cinemas in New Zealand directly to ask them about this development.

Soon after this, a news story was released by the ABC.

Owners of small cinemas call for more flexibility from film distributors to help them survive

https://www.abc.net.au/news/2023-07-06/small-cinema-owners-need-more-flexibility-film-distributors/102565052

This news story clearly demonstrates that many small cinemas are in a similar position in Australia. Unfortunately, ICA’s response to this was again disappointing. Quote:

“Independent Cinemas Association Brett Rosengarten, a former Roadshow Films sales director, acknowledges the challenges for smaller cinemas, but says film distributors have cost pressures too, including staffing and millions of dollars in advertising and marketing.”

At the ICA conference, a new CEO was appointed. I was hoping a person with a background in mediation and Australian consumer law would be chosen - A person with no former relationships or conflict of interest in the industry who could objectively help steer the organisation and its members through these difficult times.

This is especially crucial now as the “Code Of Conduct” , a precursor to Australian consumer law and how it applies to Distributors and Exhibitors, is no longer fit for purpose due to the changing nature of the industry and has become largely irrelevant.

Unfortunately the ICA board chose Brett Rosengarten, who previously worked for roadshow enforcing policy on independent cinemas, and now a distributor himself (Films At 42), representing Netflix. As a cinema owners, we are well versed in that Netflix has no love for cinema as in its eyes, the more cinema erodes, the higher the share price of Netflix climbs. I was personally very surprised that they would choose a person with obvious conflicts of interest.

Representing ICA and responding to the poor conditions for small cinemas in the ABC article above, Brett appeared to have his distributor hat on when he responded to this situation and showed no understanding of the situation or how New Zealand had adopted loose policy standards to help the small cinemas and that it should be considered here.

Many of the small cinemas in Australia are members of ICA. I expect members may vote with their feet, or unfortunately vote with the closure of their sites. Leaving only mini majors who are less affected by these poor conditions and benefitted by small satellite cinemas around them closing.

During this time, SCO had been collecting feedback from New Zealand small cinema owners and building forecasts as seen in the above analysis. On collecting this data, I have been contacting certain distributors to help them understand just how grim the outlook is for cinema, and specifically smaller cinemas.

Bellow is a extract from a correspondence with a distributor to give you a clear perspective of the argument and high stakes in regards to policy enforcement:

—

In Australia we are currently on track to achieve a similar result to 2022. Even with the many franchise films hitting the screens. Attendance is universally very soft.

You are welcome to check my work at the link above (Not supplied here). 2022 was 75.28% of pre pandemic levels, while 2023 is currently tracking to be 73.46% of pre-pandemic levels.

In brief, we are looking at 25% down on pre pandemic levels again like 2022. Plus dealing with significant power, insurance, consumables, wages rises, while maintaining ticket price levels. If we also add the fact that consumers are indexing strongly towards PLF screens. General small independent cinemas are 35-50% down on pre pandemic levels of turnover.

At the Independent cinema conference this year, the main point of gossip and discussion is that New Zealand no longer utilised policy or minimum guarantee. This has a lot of people talking as to allow a small independent cinema to play a wider range of content and then hold over films making the best return would likely lift the profitability of those locations by 20% at a conservative guess.

Due to the gossip on this topic and with my work at www.smallcinemaowners.com.au I contacted a number of small independant New Zealand cinemas to clarify if this news was actually true.

The following Emails basically sums up the general response I received from a few exhibitors

---

Interesting topic.

Firstly I don't believe that session policies have been abandoned, however I think as a general rule our exhibitor-distributor relationship is generally

really good and it allows for more flexibility. After all both parties are trying to maximise box office so we tend to work together as opposed to a format dictated solely by the distributor.

Most films I book the session policy is not even mentioned, however there are some 15 years of track record in place so they know what to expect. Session policy is stipulated by the only Australian based distributor that I deal with and as a result I'm less likely to book their movies.

So I think the answer to your question is that here in NZ we enjoy a good healthy commercial exhibitor-distributor relationship with a decent level of mutual respect and understanding, which could very well give the impression that our dealings are without session policies.

---

Or this one, specifically tells the story of the industry and how they are doing financially.

---

Yes, the industry has not recovered here yet either. I’ve had three years of losses. Ironically, the last financial year (to March 23) was the worst of them all as the government subsidies dried up and we were still not getting enough content. As a result, I’m now trying to sell my cinema in ***. Certainly a number of independent cinemas in NZ have been sold over the last year.

Yes I completely agree with your theory that dropping session policies would grow the box office. It would also incentivise the distributors to promote their films harder and try new things. If exhibitors are taking more box office overall then that must be going back to the distributors after all. Yes, the underperforming films will get less than they would with a rigid session policy, but all other films would take more. So distributors would win some and lose some. But the net result would have to be an overall gain for them.

---

The hard truth is that most small cinemas have not made a profit in the last 3 years. As 2023 is looking similar to 2022, we can assume they will not make money for the foreseeable future.

Currently, the industry narrative is, "the recovery continues". Especially UNICs recent report during CineEurope. All graphs point up. Cinema owners grab onto this false narrative for dear life as the alternative is hard for them to face. However, as the metrics in Australia indicate.. The trend is now securely set. It's extremely likely 2023 will not make any more money then 2022. The recovery has already happened, This is the new normal. If you have not started to make money yet, you are not likely to do so for the foreseeable future.

When this sinks in, we will see a mass closure of cinemas.

—

The submission goes on a lot more into details of how it is affecting small cinemas. I do not wish to go over it here as I imagine it's very distressing to those in the situation.

These arguments have generally been well received with distributors offering thanks for the detailed analysis of our region.

I want to remind cinema owners, policy was scrutinised in the original 1997 review of the industry by the ACCC. Policy was not seen as fair but due to the costs of film prints, it was allowed to ensure a print made it’s money back. We no longer have film prints. We should no longer have policy.

Trends in cinema also predict that 1,2,3 screen cinemas will become more prolific as new cinemas opening in recent years are predominantly entertainment venues, bars, Restaurants, you name it, with a few cinema screens. EveryMan, The Light in the UK, Alamo Drafthouse in the U.S. are good examples of this. The relaxation of policy enforcement will only become more important as the industry changes to cater to the changing habits of the consumer and the cinemas constructed in a way to best attract them.

In other words, it's inevitable. Better to address this now and maintain smaller independent cinemas than to lose them.

Whats next

I am hopeful that SCO and its representations to the industry will result in change. The conditions are grim and the only life preserver the distributors can offer a small cinema is to abandon policy and hopefully reduce minimum guarantee. I believe this will happen due to the clear and two way conversations I have had with key players in the industry. I feel Barbenheimer may be a great boost and a positive outcome, but a change in the industry as outlined above will bring commercial viability back. And that's the best news of all.

James Gardiner

[m] +61 4 12 997011

Small Cinema Owners Association (SCO)

Suite 129, 9 Hall Street,

Port Melbourne, VIC 3207

[p] +61 3 9686 5415

Web: www.smallcinemaowners.com.au