Small Cinema Owners Newsletter, July 2024

Coming off the highest Box Office films of the year, InsideOut2/DespicableMe4/Deadpool&Wolverine, I wanted to write a newsletter. It's been a tough year up until now and I must admit, it has been hard to find the motivation to build a narrative for a newsletter. While we are all a glow with building on this promising Box Office turnover the last month, I feel it is a good a time as any to cover the challenges ahead. Let's be honest, this year is not over and the predicted compression in Box Office due to the strikes in Hollywood is leaving its mark, especially before the holidays started. But with the success of Deadpool&Wolverine and the traction of comedic action, the following of Borderlands and Beetlejuice films would appear to be good formula to overcome the predicted compressed attendance levels.

In this newsletter I want to go over all the trends, good and bad, that have surfaced at recent industry trade shows, CinemaCon, CineEurope, plus go over an example of how a cinema should look to external research to help navigate the next few years. Some of this will be confronting, but better to walk forward with your eyes wide open.

To be clear and upfront. The current environment is no longer affected specifically by the pandemic and a recovery. We are now in a recessionary environment. How this affects any individual cinema is very different from the pandemic recovery. This newsletter will predominantly try to equip you with information to help you identity how the “cost of living crisis” will affect your catchment. Unlike the “pandemic” it is far more selective.

SCO newsletters have captured a world audiance, with mentions at ISDCF and other industry focused groups. Although I am trying to cater to a broader reader in future newsleter, I wanted to make sure my target audiance, Australian Small Cinema Owners, are not overwhelmed by the narratives given below. The items covered below are coming from a world perspepctive. The narratives and how they translate into regional small cinemas will be very different from the general trends portrayed. For example, the trend towards an entertainment complex and how that translates to regional cinema communities can be very different to metro locations. The target reader should be aware of this and take on these trends and how they may be applicable to regional locations in context.

The Reset has started

Universal’s Donna Langley Suggests, “Theatrically, the global marketplace is down about 20% from 2019 to now. And we don’t really think we’re going to recapture that. It’s okay. I think as an industry, we can withstand it.” (See, Universal’s Donna Langley Suggests Box Office Will Remain Down About 20%)

If you are a regular reader of the SCO newsletter, you would have seen our analysis predicting this during the pandemic. I would also agree that the industry can metabolise this reduction without a significant contraction. However, the problem facing the country, not just cinema, is an economic downturn. We are in our 5th quarter of negative GDP per capita growth. In other words, consumer's spending power is contracting every week and is expected to continue for the foreseeable future. The only good news here is that, things will eventually improve. The issue here is the length and deepness of the economic conditions and if cinemas can make it to the other side.

This cost-of-living crisis is not universal. You have to go granular to understand where it is affecting the Australian population. Cinemas are very much being effected by this, with some seeing as much as 40-50% reduction while others are barely seeing the baked in 20% as has been acknowledged by industry heads/experts.

Recent news on Cineworld, after just coming out of a restructure, has announced it will be closing 25% of its sites in the UK. While, AMC has done a desperate deal, trading ownership with its current debtors to keep them at bay until 2029.

If you are a cinema owner like myself, you are asking yourself. “Am I on the right side of the economic roulette wheel?” Hopefully by the end of this newsletter, you will have the means to figure that out.

Trends seen a cinema trade shows

In the hallways of a trade show is the best place to hear the whispers of exactly what is happening in the industry. Unless an article in a trade magazine says ”Graph goes up”, it's next to impossible to get your article printed. No one wants an ad next to a doom and gloom article. (Why this is a newsletter, so I have the freedom to be honest.) Typically, you will hear the narrative of, “the recovery is still happening”, just keep waiting. “Hello” it's been near 5 years “Hello”? The recovery has happened, consumers are changing behaviour and are still doing so. Universal has conceded that 20% down is likely never coming back, but in reality, consumer behaviour can take 5 years to metabolism, we could see a +/-5% in the coming 2 years affecting visits per year per person. We just don’t know.

Entertainment complexes

The effect of these trends is small films do less and big films index higher. But on average its 20%+ down on pre-pandemic/pre-streaming levels in the face of higher rates, insurance, staff, you name it. Due to this, a major trend has occurred. Traditionally, the run-of-the-mill film we open each week would have been enough to keep the doors open. Even if no film went viral, we had confidence we would be there the following year. Based on trend seen before the holidays, with the general film now making considerably less. This is no longer the case. The industry is branching out into more reliable adjacent offerings and in effect transforming into entertainment complexes. (Bars, restaurants, laser tag mini-golf, climbing, etc) This brings the business back into an equilibrium and reduces risk, ensuring the cinema can stay open between the times a viral Film does land. Cinema is no longer the core business. Entertainment is. Cinema is just an item on a larger menu of offerings.

This is obviously a major departure from traditional cinema as staffing and the day-to-day operation of the business has grown in complexity. It is no longer a few older managers and an army of young, inexpensive staff. You now need older and highly trained staff. A cultural shift the industry would prefer to avoid. Managing a more diverse staffing requirement takes more effort and less profitable.

This can be seen in the massive investment by many cinemas to pivot to an “Entertainment Complex” where “Cinema” is not prevalent in the name. In effect, cinemas are turning into entertainment companies offering numerous options. A destination for entertainment. NOT just a destination for cinema. This transition can be seen as most of the newer cinema openings are dropping “cinema” of the marketing material. (“Everyman”, “Alamo Drafthouse”) Or by larger traditional multiplexes repurposing a significant portion of their real estate to alternate entertainment. For example. Hoyts Highpoint utilised about 45% of its area to create the “Funderdome” (https://www.highpoint.com.au/stores-services/the-funderdome) while upgrading all seats to recliner/gold class. (I encourage readers to visit this site as it is well done)

PLF is so hot right now

With a trend in attendance levels going down, we are also seeing trips to the cinema become more valued by consumers. They may go less, but when they go, they go large. This has lead to a large shift to PLF (Premium Large Format) with IMAX specifically benefitting from this trend. The reaction to this is for IMAX to announce plans to expand into Australia in a major way (https://if.com.au/imax-outlines-its-ambitious-plans-for-australia/) with 39 more screens.

Not to be left out, with cinema attendance levels in poor shape, many non specific PLF cinema chains are also looking at options. They are holding off as long as possible in reinvesting into the next generation of projectors, so sales are greatly compressed. This has led to cinema equipment vendors diving into the only promising market left. PLF.

Barco - Light Steering Projectors, Christie's CINITY, Dolby Vision new direct to Cinema Projector, the market has exploded with PLF class offerings.

Personally, I find this a worrying trend as, it will not take a lot of new PLF offerings to over saturate this market. I would recommend extensive market research on demand is performed before taking this route.

Reduction in screens or reduction in seats

With the lower attendance trends being observed and with this the lower traction on films, there is also a trend for sites to lower screen counts or lower seat count per screen (i.e. replace standard seats with recliner). This obviously feeds into the trends already outlined above.

The Hollywood strikes and the fallout still occurring

The Hollywood strikes so soon after the pandemic has been a perfect storm. It is dumbfounding that 2024 is all but certain to be a considerably weaker year in Box Office in the immediate years after the pandemic. I.e. 2023.

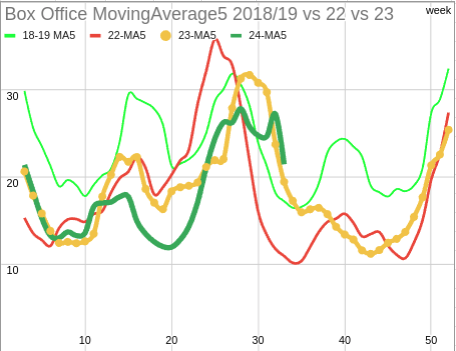

The graph above is of the Australian Box Office based on the Numero total for each week. I put the weekly Box Office total in to a spreadsheet to calculate the performance from year to year. Based on this, we can see the performance of the years after the pandemic. Below I compare it to 2018-2019 averages.

| 2021 | 2022 | 2023 | 2024 est. |

|---|---|---|---|

| 49.37% | 75.28% | 78.72% | 76-80% |

The notable trends seen in this graph are as follows:

- The 3 months running up to the mid-year holidays were exceptionally poor. Many films with decent reviews still did not attract patrons. In general, a cinema owner would have expected considerably more attendance levels going on the quality of the files and comments of patrons as they left the cinemas. However, the attendance levels stayed weak. This is predominantly contributed to economic conditions.

- Once the holidays started, consumer behaviour switched to spending with abandon. Specifically focusing on kids and allowing them to have a good time in the holidays as “Inside Out 2” and “Despicable Me 4” appeared to behave and attract attendance levels seen pre-pandemic.

- Films, specifically dramas, targeting the older demographic, have seen major compression. “The Bikeriders” and “Fly me to the Moon”, both well reviewed and praised by those attending, have both underperformed significantly. If this trend were to continue, it would be a significant problem for the industry.

- Now hitting Deadpool & Wolverine, we can see the mid to older demographic will, even in this environment, go out of their way for a “must see experience in the cinema” film such as this.

Deadpool & Wolverine has lived up to the hype and shows, even if people are tired of generic MCU/super hero offerings, comedic action would appear to be a desirable offering at the moment. This is a positive outlook as more content with a similar feel, “Borderlands”, “Beetlejuce”, are coming. Hopefully these films can hold this interest and also index higer then expected. It is very possible the industry out performs the predicted negative growth based on the limited contant resulting from the strikes. This shows, that having the right content and making quality content can win over making a lot of content poorly and hoping one strikes gold.

Has Hollywood recovered after the strike and what does it mean for Exhibition

A leading indicator the exhibition industry should be more aware of is the recovery after the Hollywood strike. I became aware of this metric as, working for a Post House here in Melbourne, it is very apparent that partners in Hollywood have not bounced back after the Hollywood strike. A general Internet searches will bring you stories such as.

- This time last year, Hollywood writers were on strike. Now, many can’t find work

- Hollywood writers say jobs are scarce a year after strikes

- A year after the actors’ strike, Hollywood continues to face a labour crisis -

“L.A. County’s entertainment industry employed about 100,000 people as of April, which is 20 percent less than pre-pandemic levels.”

If you have a deeper interest on this topic I recommend listening to a Podcast directly from LA. “The Terence and Philip Show, Ep 86”. These LA based production professionals to over exactly how hard it is to get a Job in LA at the moment, and how the fall of peak TV and a large reduction in budget has resulted in far fewer productions. This started before the Strike.

In essence, we can see that after the strike, the industry in general has not gone back to the same level of production. Likely lead by the streamers turning down spending on production due to profitability and the misgivings of “Peak TV”. This is affecting all production, including theatrical, as the amount of money being spent on production has been greatly reduced.

The message here is that, even though the strike is over, and production has restarted, we should not expect the number of films being released to go back to the levels seen before the strike. This will have a direct impact on cinema exhibition turnover into the future.

This also explains why we are still seeing some titles move their release date out further, as they seek as little competition as possible on their date of release.

Unfortunately, it also indicates that films, being the fuel that exhibition runs on, will see a continued compression in number and quality over the coming years.

Sundance purchases Paramount

After Fox was purchased by Disney, going from 6 to 5 major studios. The exhibition industry has felt the negative impact of consolidation, as the number of tent pole films being released per year was noticeably contracted. With the purchase of Paramount by Sundance, can we still consider it a major studio and with it the investment expected into tent pole films?

The jury is out, but there is a consensus that the diverse outlook by the Sundance management would leave less focus for theatrical production. See: “Hollywood theater owners are worried a Paramount-Skydance merger will usher in too much consolidation”

Sony purchases Alamo Drafthouse

This appears to be the most interesting development in recent time as it surfaces numerous shifts in the landscape of cinema exhibition.

Background: Sony Buys Alamo Drafthouse In Surprise Move—Here's How The Theater Chain Went From Bankruptcy To Sale

Wall Street investment

The key here is to look at who was selling Alamo Drafthouse and why Sony purchased it. The previous owners were made up of “Fortress Investment Group” or in other words Wall-Street investors.

Alamo, being a smaller cinema chain in the U.S., was a widely known name around the world as it was seen as the emerging trend in how to run a modern cinema. I.e. as an entertainment complex with a focus on food and experience with a side serving of Cinema. Low number of screens. This was seen by Wall Street a promising growth story. Alamo was steadily growing but in so spending its reserves, making it flat-footed when the pandemic arrived and little runway to navigate the following economic downturn the pandemic resulted in. This forced it into a Chapter-11 restructure, only to come out of that into the strike and economic downturn.

It is no wonder that a year after coming out of chapter 11, Alamo was again looking at a complete collapse.

Days from going dark, Sony, a company with a vested interest in not sending to the market a message that cinema as a business is flat lining, steps in to save the company.

The first major message we can take away from this is, in this synchronised world economic downturn, cinema will find it hard to raise any cash for extending the runway/time over the coming cost-of-living-crisis that is gripping the world, not just Australia.

The Paramount Decree

The other factor of the sale that has heads turning in that, even though the “Paramount Decree” has expired, there has been a general acceptance that distributors and cinemas should not be vertically aligned. (Distributors should not own cinemas).

Background: Terminations of the Paramount Decrees: A Greenlight for Monopolies

in United States v. Paramount Pictures, Inc. produced the Paramount Consent Decrees, an antitrust standard intended to thwart the vertical integration of film studios. The standard forced the sale of movie theaters, which would often exclusively show movies produced by the studios that owned them, and took measures against block booking.

Although Sony was not a signatory to the decree in the first place, it was generally accepted that an invisible line existed when it came to vertical integration of the industry. However, with streaming becoming the monster in the room, and streaming, by its nature, is a direct studio to consumer model. The Paramount Decree, is seen as antiquated with no present day ramifications. It is no wonder it was terminated.

With all the changes in the industry in recent years, the only certainty left is more change is coming. With the vertical integration line now gone, certain risks are now in play. The early indications of this are.

- Sony purchases Alamo Drafthouse, will they move to exclusive content releases? (A form of new window)

- Netflix Is Putting Entertainment Complexes In Shopping Malls - expanding an outlet for exclusive movie offerings?

As cinemas have been seen as key tenants to large shopping centres as they uplift the profitability of all businesses around them, is the new model to use exclusive content by the streamers to direct foot traffic to real estate or businesses interests?

With the call for the lowering of ticket princess and easy of access to films push streamers to open up the typical “Sports TV” channel model to sports bars, to also allow any entertainment complex to install a set top box and start also offering cinema-type experiences in any venue that has a suitable cinema like space?

These types of models have been unthinkable up until recently, but now must be placed on your radar for potential industry shifts that may significantly change the business of running a cinema. The small but notable changes I have listed above, would appear to indicate we are slowly moving in this direction.

AMC seeks a long runway in economic environment

AMC being the bigest cinema chain in the world, is always an interesting topic. Especially as it has a significant dept issue. How it handles the dept will, or now is, a window to what they expect long term.

So lets have a look:

AMC Theatres Secures Refinancing Deal to Push Debt Maturities to 2029

Breaking this story down into its essence, AMC has done a deal to hand over a large chunk of the ownership for a dept holiday that goes until 2029. But that does this tell us?

- Wall Street has no interest in investing (As has been seen in the Alamo deal)

- The investors are desperate, and have agreed to forgo the interest of the massive amount of dept until 2029. If they push the point, the chain goes into Chap11, so better to give them runway to navigate over the upcoming economic downturn and hopefully come out the other side with something.

- The runway is near 5 years long, giving us an indication of exactly how long AMC expects it will take before things improve.

TheAnyThing model and its ramifications

This industry is obviously considering alternative types of models as can be seen with a pilot offering in Europe. “TheAnyThing” personal cinema model is a offering in that small automated cinemas can be booked to run any content, including day-in-date releases. In effect being a SetTopBox experience that includes date-in-date films. This offering would require a significant move away from the typical policy and minimum guarantee to allow this model to be viable. If this new cinema business model is accepted by the distributors, it would open the door for any venu to install one of these private function rooms opening the accessibility to cinema to any consumer facing business.

This would completely change the dynamic of how cinemas work and compete. With larger chains likely to be significantly effected, but at the same time, likely improving attendance levels as access to the market will be significantly improved for consumers.

The Drive-In curse spreading to Multiplexes

Australia has some of the most expensive real estate in the world. This leads to very high prices for goods as the yield per square meter has to be significant to make up the rent or land tax costs of the property being used. The closure of the Luna-Drive-In in recent years has been a devastating blow to the culture of cinema and the varied ways to enjoy it. Being a well maintained and well attended drive-in, it simply could not justify the government taxes that such a large piece of land in a populated area demands. It became commercially unviable as land prices increased and with it, the taxes demanded each year.

Unfortunately, this issue is becoming so extreme, that is is starting to effect larger multiplexes as well.

Eyes wide open to industry threats

I have covered a lot of leading indicators for warnings ahead. It does no mean it is a forgone conclusion. All these factors, affecting you as a cinema, are inputs on a probability calculation that you need to make for yourself and how you manage your cinema into the future. As a industry we need to be ready for whatever happens. I would also like to remind the reader that cinema has tradionally done well in a recessionary environment as it is a cheap form of entertainment and social cohesion. With the explosion of streaming, potentially corroding this dynamic, recent attendance levels of “InsideOut2”, “Despicable Me 4” and now “Deadpool & Wolverine” would indicate cinema is still strong in this environment.

Identifying the long term economic outlook for your catchment area

In this article, I have been outlining the key developments in the industry and specifically identified that economic conditions as a key factor going forward. Unlike the effects of the pandemic, which are more global in nature, affecting everyone a similar amount, the economic impact is far more granular.

I will now explain how to use external economic data sources to get a better understanding of how your catchments are being effected. To do this we will use a data analysis company called “Digital Finance Alaytics” This company presents a lot of its data in a general overview on youtube channel (@WalkTheWorldDFA) but you can also hire them for more detailed information. (Australia and UK. if outside these areas, you will need to find similar agents in your region)

For this demonstration, lets look at a recent surprise closure and see if using the data can give us an idea why “The Regent Ballarat” suddenly closed just before the holidays.

Taking the temperature of the country

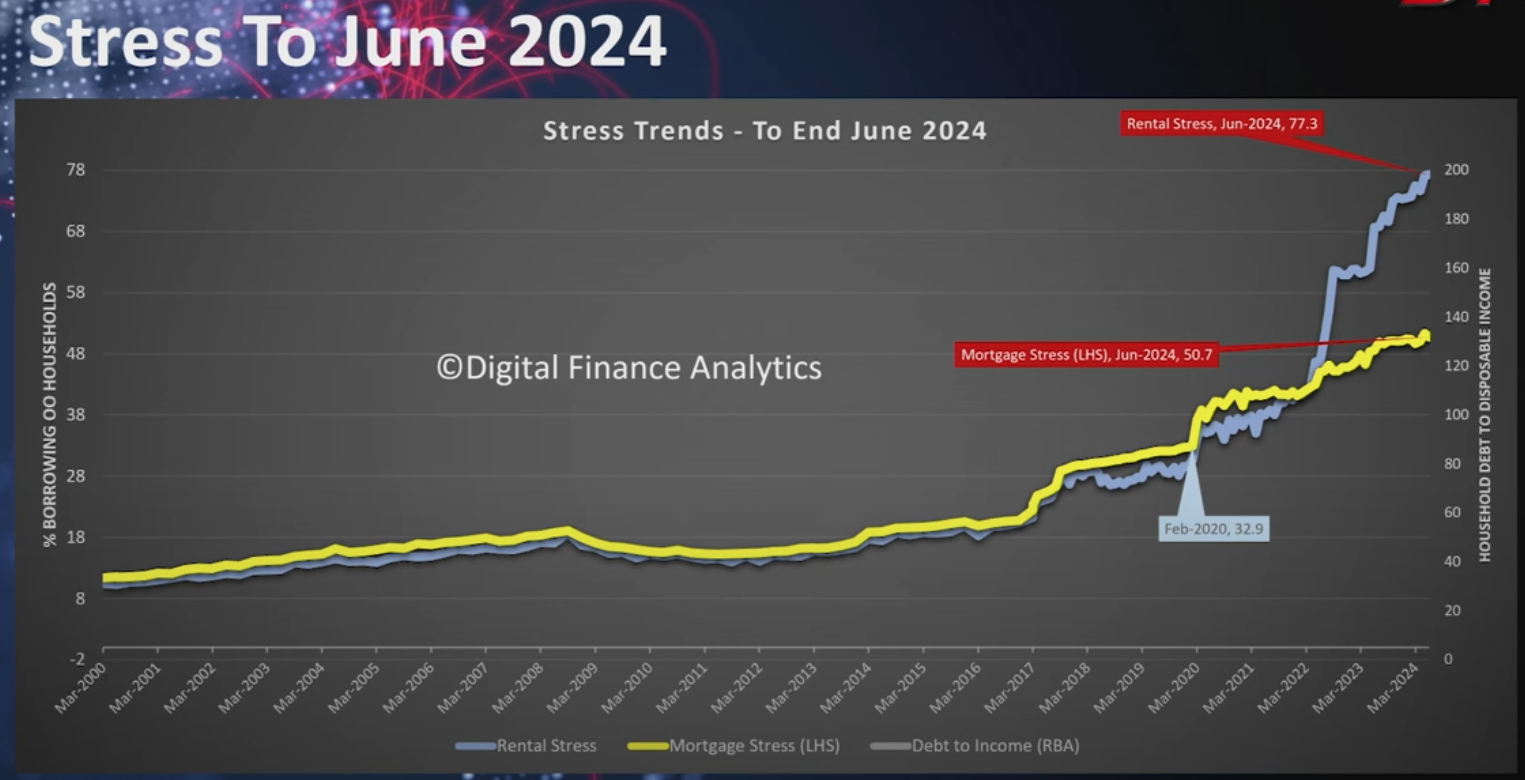

The recent video from DFA, see https://youtu.be/BBMRWNtPKcs?si=oSWd6SYgpYkCAytK&t=274

It shows record high rental and mortgage stress. Levels never seen before in recorded data.

As we can see, mortgage and rental stress is at record highs. This follows as the cost-of-living-crisis is headline news on a daily basis.

As a business owner, the most valuable data to help us navigate this crisis over the coming years is to know exactly where the crisis is affecting the catchments.

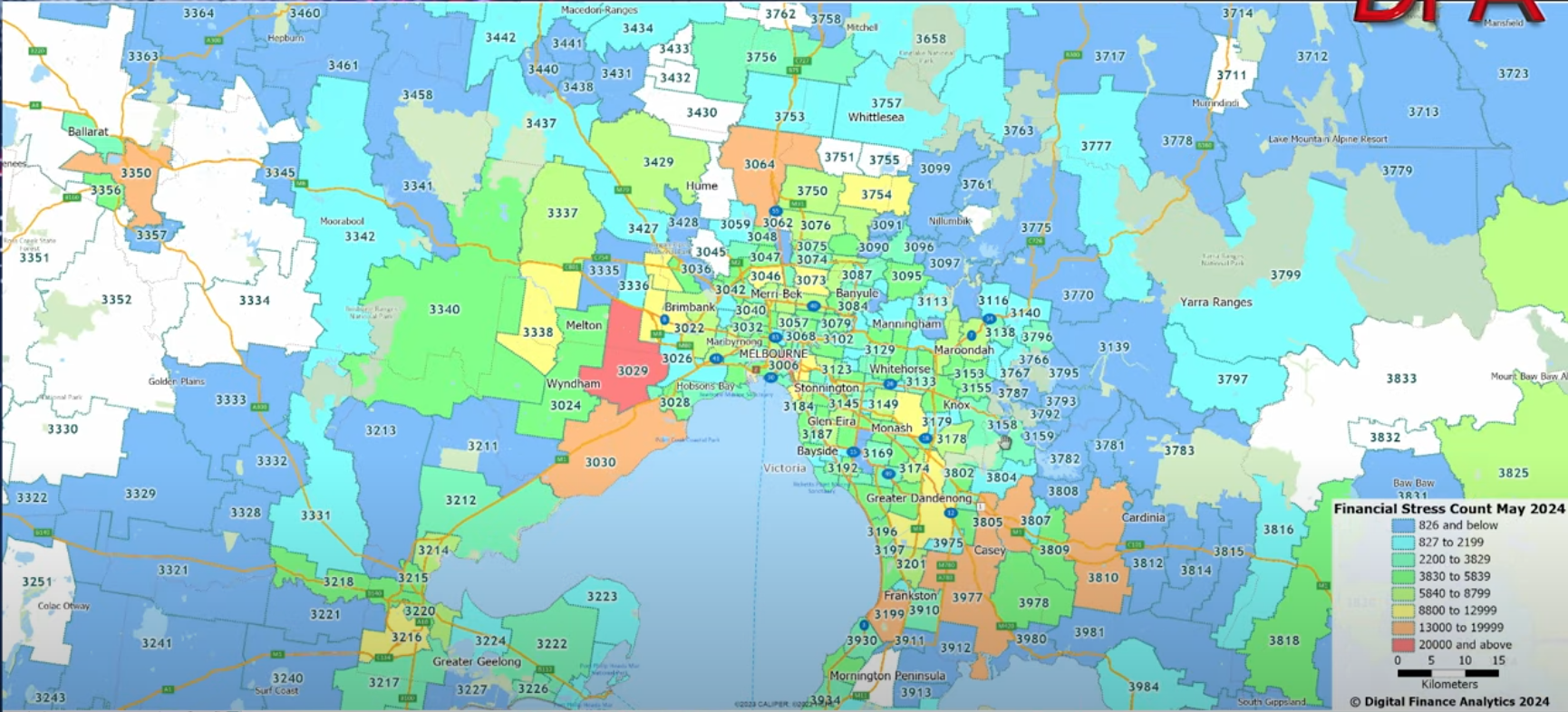

The following image is taken from https://youtu.be/bcoRoixJVR0?si=ZUrxPvOEya2uwGHU&t=621

And shows that Ballarat is one of the worst hit areas and is in "extreme" rental and mortgage stress. (The 3350 post code, far left in orange)

In other words, as is indicated in the level of mortgage and rental stress, Ballarat is indexing to the higher side of this data and is likely to higher than the average stress levels portrayed in the already record high stress levels..

This would clearly explain why the Regent is likely in severe attendance shortfall. Any cinema located in yellow/orange/red catchments will have severely constrained attendance levels as this data would indicate the cost-of-living-crisis is especially high.

How long will this stress last

This is obviously the next question, especially if you are effected by the high stress levels. Unfortunately its not good news. Economists expect it to get even worst before it starts to get better. With interest rates expected to stay high for longer or even to rise more due to inflation up tick. Plus unemployment edging up, don’t expect a pay rise.

I am not an economist, but in studying this over the last year, only after government policy changes can we expect an improvement. Lowering of interest rates will only occur in the face of elevated inflation if things are getting a lot worse. (You don’t want to go there worse) The path forward is major government policy restructuring. And a lot of time for wages growth while house prices and rents stay steady. Then, consumers will be in a position to start covering these mortgages/rents and build up savings again. It would take a long time. Note, AMC mentioned above, obtained a 5 years dept holiday would be a good indicator.

Links to capital cities for stress analysis

Below I will place links to the DFA youtube video covering heat maps for capital cities. This may give you an idea on te stress levels in your catchments. Otherwise, DFA is very cost effective if you want them to specifically review the catchments of your interest.

Coming up

In my next article, I will be continue this analysis. Specifically looking at how the business of cinema is changing. i.e. fewer screens, policy and MG changes. I will also look at the music industry and its long term changes after going through a similar transition into a streaming dominated world. Its not a direct comparison but we can learn form certain consumer behaviours that may transfer into cinema or explain new consumer behaviours/attendance levels.

Based on this article analysis, I will make some general suggestions to small cinema owners on what to look out for and possible directions we should lean into to ensure our future.

I would also appreciate feedback from the reader on what they would like me to cover, or in particular, if in your opinion, I have gotten anything wrong.

SPONSOR

Digital Cinema Network (DCN), the company I operate, is looking to offer its internal services to the wider small cinema exhibition industry. DCN is the only company in Australia operating completly autonomous cinemas, DCN has a skill base that other small cinemas can leverage. We offer consultancy but more importantly:

- Booking services: keeping track of what movies are coming, and booking suitable movies for you location.

- Automation of your projection equipment: Our backend systems will automatically program you projectors and load all DCPs. You just sell tickets.

- Website integration: based on Wordpress plugins, add cinema session times that automatically update based on what has been booked and scheduled.

- Expert diagnostic analysis of faults to minimise your supprt costs and visits.

- Remote training and technical advice for your staff.

- Consultancy on how to optimise and automate your cinema backend processes.

Free stuff

SCO also offers CRU caddy units for small cinemas at no cost (+shipping). If your CRU caddy that takes drives from distributors has warn out. Grab a backup unit now.

The cinema-catcher-app, a free tool created by DCN. This is a automatic LMS (Automatically download content from delivery boxes or FTP servers, AutoKDM, automatically ingents KDMs from your Email into your TMS or directly into your DCI-Players, Daily Audits of playout and reports) Get it free at https://github.com/jamiegau/cinema-catcher-app

Thanks for reading,

James Gardiner

Principal at Small Cinema Owners Association (www.smallcinemas.com.au)

Email: james.gardiner@smallcinemaowners.com.au

2 comments

Harold HallikainenAugust 1, 2024 at 8:24 am

Nice extensive analysis, but the low contrast of the text is really hard to read. Is there a reason to not use black text?

jamiegAugust 1, 2024 at 4:00 pm

I don’t see it being that low. Maybe your screen is a bit over bright? It’s an off the shelf website template.